The Budgeting App That Will Make Managing Your Money Crazy Simple

I tend to resist budgeting apps and software (especially after my EveryDollar experience) because I’m a bit of an Excel nerd and a control freak. I have this intense need to account for every penny and I literally can’t sleep at night otherwise!

Needless to say, I’m a budgeting spreadsheet convert and have been for at least 15 years now (ever since my mom taught me how to budget!).

But so many people recommend YNAB (You Need a Budget) that I knew I had to try it! Just so I could say my spreadsheet was better. 😂

Confession: It wasn’t love at first sight.

(I know, that’s not how you expected this You Need a Budget review to go, right?)

It actually took me a couple weeks to totally understand the system because I was trying to jam my years of one budgeting mindset into the YNAB software, instead of letting the app work for me.

But once I stopped micromanaging everything and pretended I was a new user who had never budgeted before, it suddenly made perfect sense.

Game-changer.

And the best part is that YNAB allows Joseph to team up with me in managing our finances—and with very little maintenance for either of us! Shared budget app for the win!

Now I’m 10 months into using it and I can’t recommend it enough. Truly! I’ve said goodbye to my spreadsheet for good, which (even with its spiffy formulas and all) only made me work harder, not smarter.

If you want to get your spouse excited about budgeting and turn managing your finances into less of a chore, YNAB might be exactly what you need to shake things up in the best way possible.

Let’s dive into how it works!

The Best Shared Budget App: YNAB

What it is: You Need a Budget is an online budgeting software accessible from both your desktop and via an app on your mobile device (and your spouse’s!). You can easily connect your bank accounts and credit cards, and the software will import your transactions automatically.

Cost: An annual subscription rings in at $84/year. But don’t click away just yet! While this sounds a little pricey (it made me hesitate, too), YNAB is less expensive than the pro version of EveryDollar…and WAY better than even the free Mint!

Think of it like this: At around $7/month, YNAB costs less than a monthly Netflix subscription. So for the same price you shell out each month to be able to sit on the couch binge-watching the latest series (no judgment here!), you can take charge of your money and put your earnings toward things and experiences that you truly value.

Convinced already?

How to Set Up Your YNAB Account

When you sign into YNAB for the first time, it’s easy to get overwhelmed with all the options! But don’t stress. The following three-step process will get you and your spouse up and running in under 30 minutes.

Step 1:

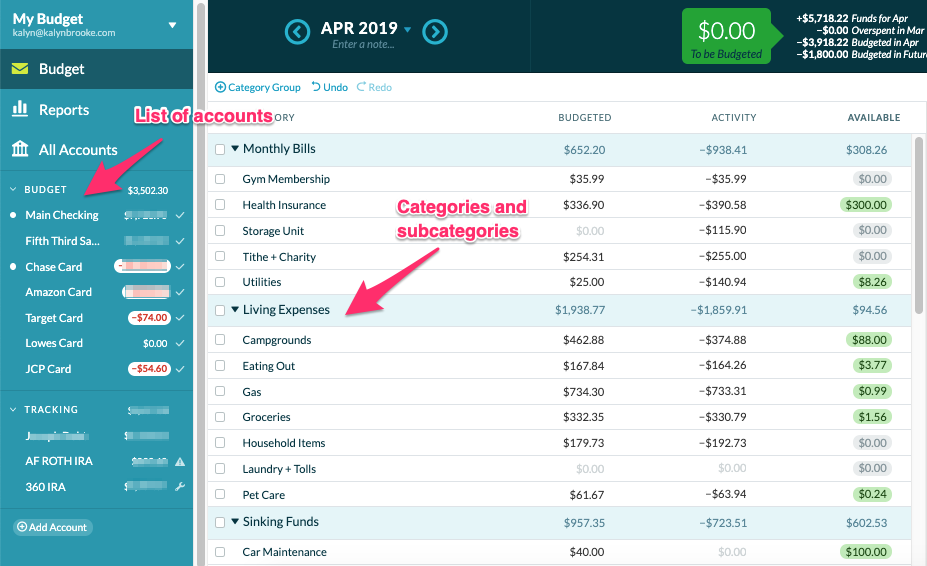

Create/edit budget categories according to the structure that works for you. You can have both main categories and sub-categories based on how detailed you want to organize everything. Yay!

I have mine sorted into:

- Monthly Bills (expenses that come due every month, like utilities and our self-pay Health Insurance)

- Living Expenses (Groceries, Pet Care, Eating Out, Gas, etc)

- Sinking Funds (Savings like Fun Stuff, Home Maintenance, etc.)

- Quarterly & Annual Expenses (subscriptions and memberships, etc.)

Pro Tip: I always recommend you start with as few categories to maintain as possible. Otherwise, you can get lost in the details and focus more on the setup versus maintaining the actual budget. You can always add more categories later if needed.

Plus, there’s a “Stuff You Forgot to Budget For” category that comes in handy too. 😉

Step 2:

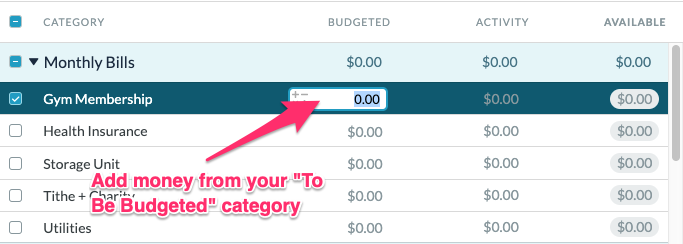

Connect your bank accounts and credit cards (it might take a couple of days for all transactions to import). Every dollar in your bank account should be automatically added to the “To Be Budgeted” Category. You’ll distribute this money to all of your budget categories until you are left with $0.00 to assign.

This is one of the things I love most about YNAB. You don’t budget based on what you expect to receive; you budget with the money you have…right now. This structure forces you to be realistic and gives you a real-time look at your finances.

Lost? If you’re not sure how to create a budget, what categories to use, or how much money to assign to each category, bookmark my Budgeting 101 series for an in-depth overview.

Step 3:

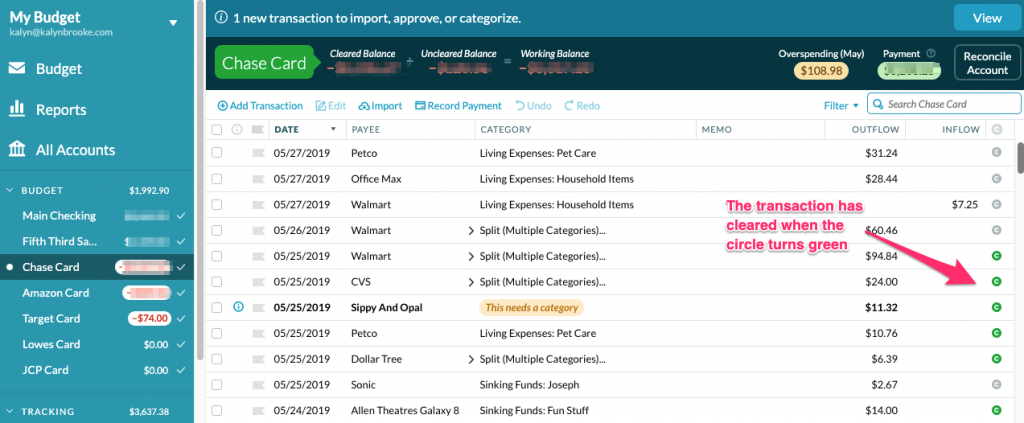

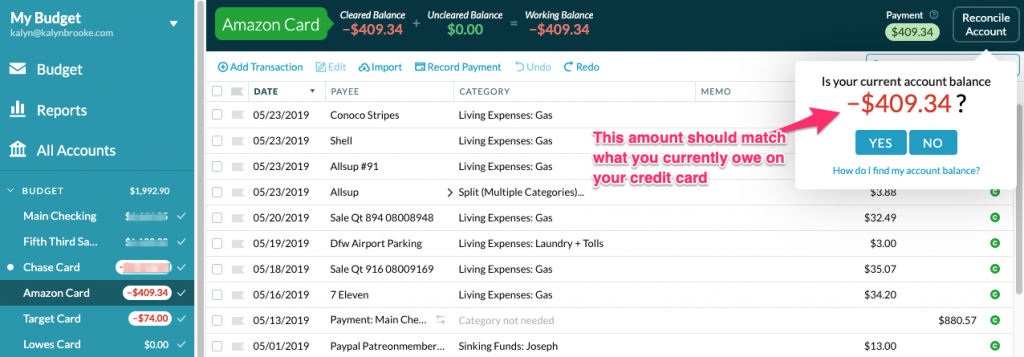

As you spend money, each transaction will import into YNAB automatically based on the account you use to pay for it: Checking Account, Credit Card, etc.

Again, this usually takes a day or two, but if you or your spouse want to stay on top of everything in real time, you can track expenses as you spend by adding them into YNAB yourself. The software will then catch the “duplicates” by syncing your bank account transactions to the one you added; all you have to do is approve it.

You can even split a transaction among multiple categories if you want!

Here’s an example of the account register for my Chase Credit Card:

Going forward, any time you receive income—from your paycheck, birthday money, or odd jobs here and there—you’ll add it to the “To Be Budgeted” portion of your budget and deposit the money into any category you want.

Weekly and Monthly Maintenance

With everything being so automated inside a shared budget app, it’s easy to just “set it and forget it.” But you still have to stay on top of everything to be successful financially, which means checking in on a regular basis.

Thankfully, YNAB makes the process much less time-consuming!

Every Week:

Choose a day of the week to update YNAB. I do this every Friday during my financial self care routine. I’ll approve transactions that have come in, assign other transactions if needed, and distribute any deposits we’ve made into our account.

Every Month:

When you transition to a new month, there are a few things to keep in mind.

1. Categories that still have money in them roll over to the next month. You can zero out those categories and start over or let them build. I usually zero out my Living Expenses and transfer that money into savings (which inspires me to spend less in those areas!). But we let our Sinking Funds build over time.

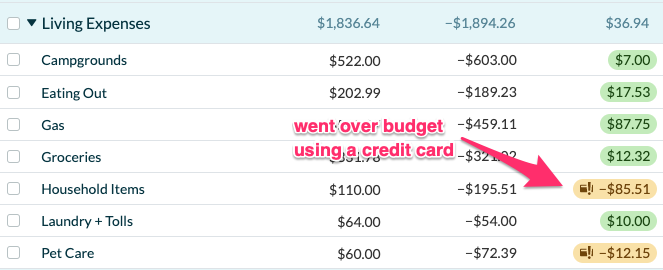

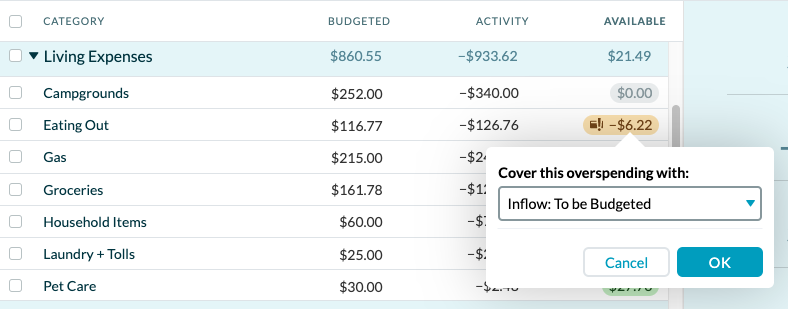

2. Categories where you’ve overspent turn one of two colors: Orange OR Red.

The credit card payment “holding” account is actually my FAVORITE feature of YNAB. I’ve always been a proponent of responsible credit card use. Part of that mentality is treating your card like cash and YNAB makes this super easy to do!

However, when you go over budget using a credit card, you MUST find money elsewhere and add it to your credit card account before the month rolls over. Otherwise, YNAB will just reset your negative account to zero, but leave your credit card payment account lacking the right funds.

This is the one part I don’t like. I did not realize YNAB did this for a few months and wondered why my credit card accounts never matched the money YNAB sets aside for payment. Yikes!

RED: If you overspend in a category using a debit card, the color of your negative balance will turn red. If left untouched, the balance will roll over as negative to the next month and also show negative in your “To Be Budgeted” category until you take care of it.

Bottom line: You must take care of all negative accounts before transitioning to a new month. But the best part is you can cover any overspending with a click of a button: the Inflow button.

3. Lastly, reconcile your accounts every so often to make sure you’re not missing a transaction anywhere. While YNAB does a great job at importing everything, sometimes there is human error too (like if you add a transaction to a wrong account…ahem).

Pros & Cons:

As with everything, there are always pros and cons to consider.

Pros of You Need a Budget:

- Assigning categories is FUN (no math, no manual transaction tracking and no searching for $.10 because of a calculation error!)

- Accessible anywhere with the mobile app

- Allows you to treat your credit card like cash

- Automates budgeting so you (and your spouse!) always know where you are financially

Cons of You Need a Budget:

- Sometimes the bank and credit cards will disconnect and you need to reconnect them.

- Transactions can take 2-3 days to process (so if you’re on a really strict budget, put it in right away and then transaction duplication will turn on).

- The cost. It may seem cliche to say it pays for itself, and the truth is, it may not if you’re already a seasoned budgeter. But it’s super convenient! And if you and your spouse are brand new to budgeting, the ease of learning to use YNAB means you won’t ever have to try another budgeting tool.

With You Need a Budget, I not only know where every penny is going, but instead of dreading the day when I need to update my spreadsheet with weekly purchases, I actually look forward to opening up the app and assigning all the transactions that come in…automatically.

It’s one of my favorite things now. I never EVER miss a transaction!

Joseph is especially grateful, because there were always a few receipts of his missing from our Receipt Jar. Now he just has to tell me what he spent the money on or he can enter it in himself. This makes YNAB the perfect shared budget app between couples.

Another perk?

You’ll be more conscious about your spending. Overspent categories turn red or orange (ick!), but when you see green (aka positive balances!) while scrolling through the app, it will inspire you to come in under budget every time.

I especially love transferring that extra money elsewhere, (like our Rize Savings Account) to fund our financial goals.

One last reminder: To make YNAB work, you must get rid of all other budgeting mindsets and approach this method with an open mind. But once you start, I promise you’ll be hooked! YNAB has the potential to change the way you view your finances forever.

And who knows? You might just find you become a budgeting nerd like me. 🤓

Try YNAB for free for 34 days!

Let’s chat about budgeting apps:

Have you ever tried a budgeting app before? Do you have any questions about how YNAB works or anything I need to clarify further to help you make the best decision for your finances?

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

Hi Kalyn –

I’m curious if you use Ramsey’s budgeting group topics (housing, medical, food, transportation) so you can see your percentages or YNAB’s topics (immediate/monthly expense, etc.)? I’ve been using Ramsey’s topics for the past few years in YNAB, but now with the YNAB chrome extension and implementing goals for each line item with automatically funding underfunded items with a simple right-side button, it seems more efficient to have priorities at the top of the list, rather than searching for the priorities in each of the Ramsey group topics. Does that make sense?

I actually don’t use the goals feature of YNAB so I’m not sure I can give you a great answer! But YNAB has a great customer service team and I’m sure they can help you if you reach out!

Over the years I’ve used MS Money, Quicken, Mvelopes, EveryDollar and now YNAB. YNAB has by far been the best. You really do need a slightly different mindset though, since you’re budgeting money you HAVE. And because you’re budgeting money as you receive it the default Groups make a lot of sense. Immediate Obligations are the bills and budget categories you fund first as you need to pay your bills, eat and put gas in the car. True Expenses are important for long term financial success. These you fund as you have extra money, sinking funds, savings goals, etc. Just For Fun categories are completely discretionary: dining, entertainment, blow money. If you have some debt to pay or some unexpected car repairs, maybe these don’t get funded. This organization helps you figure out where to put the most recent income to work AS you get it. Great system!!

It took me a while to adjust to the system, but I was actually ahead of the game as my spreadsheet system before this always budgeted based on what I had. My budget always matched my bank accounts. 🙂

Okay, I’m so excited to find another budget and spreadsheet nerd 🙂 I’m finding it really hard to let go of my adored budget spreadsheet (I honestly love creating and updating it!), but I’m hearing so much about these budgeting apps + I like the idea of being able to check quickly on my phone (with a better user-interface!) and share with hubby. I’ll give YNAB a shot…if you converted, then there’s hope for me!

Trea,

I’ll always be a spreadsheet nerd at heart. But (and I never thought I’d say this) I will never be going back to my budget spreadsheet. YNAB has saved me so much time in the long run. There were some learning curves, and there were a few times I just wanted to throw out the app and go back to my spreadsheet, but now I love YNAB just as much.

Hi Kalyn, I want to try YNAB because Every Dollar will not connect to my credit union. Regarding the connection problems, is it easy to reconnect? I hope so. Also, I get paid twice a month, on the 10th and 25th, and like to run by budget from the 10th of each month to the 10th of the following month. Is this possible with YNAB? Thanks for any help you can provide.

YNAB works on a monthly budgeting system – but we get paid twice a month as well and I make it work by allocating 1 paycheck to half of my monthly expenses and the other paycheck to the other half of the expenses. We’ve had no issues with getting our accounts connected.

Hi Kalyn,

My wife and I can totally relate to your budgeting journey! Thanks for posting the review of YNAB.

Is YNAB limited to a monthly budget? I’m wondering if once-per-year expenses like a property tax payment can be scheduled in full for the month it occurs in, or do you have to save for it every month?

I guess what I’m really looking for is a cash flow app. I’d like to lay out my whole year and see when the cash actually leaves my account. Is this something YNAB can do, or do you know of anything like that?

Thanks!

Thank you for sharing your opinions on YNAB and EveryDollar. I have attempted ED a couple oftime without much success.

I plan to try out YNAB this week because it seems to do more for the money and I want to be a budgeter instead of a “oops. I forgot to plan for that” kind of person

That’s great, Rhonda! I hope you like YNAB. I never thought I’d leave my spreadsheets behind but here I am using YNAB and I don’t think I’ll ever turn back.

Where do you put things like loans, house and car payments, student loans? Mine went under Tracking and I can’t figure out how to move them back to Budget.

Hi Cheryl,

You can use YNAB to track a debt, but otherwise you just want to have a category in your budget (example: Mortgage payment) where you budget the amount that needs to come out every month.

Here’s more detail on that: https://classic.youneedabudget.com/support/article/other-debt-accounts

I hope that helps!

My wife has just about had it with EveryDollar missing purchases. I might switch to YNAB if I can’t get it fixed soon.

That’s no good! We haven’t had any issues with YNAB missing anything yet. 😀 I always hate it when I pay a premium for something and it doesn’t live up to it’s own expectations.

This looks great. Do you know if it can connect to foreign accounts? The fact that Mint did not is what made it unusable for me.

Currently, it looks like you can manually import files of transactions for foreign accounts but not connect them automatically. 🙁