An Honest Look at Life on One Income

This post may contain affiliate links. Read my full disclosure policy here.

Please join me in giving Kristen from Joyfully Thriving a warm welcome! I find her story SO inspiring, and am super excited she agreed to share her wisdom with us. Be sure to make your way over to her sweet blog when you’re done reading this post—you’ll find loads of fun and frugal tips!

– – – – –

Are you living on one income – or considering the switch to one? Maybe you’ve chosen to be a stay at home mom while your husband works. Maybe your husband was recently laid off and you’ve become the main breadwinner for your family. Maybe you and your spouse both work but you’d like to leave your job.

I’m here to share an honest and I hope, encouraging, look at the reality of life on one income.

You see, I’m a stay-at-home mom of 2 children under the age of 2, married to my hard-working teacher husband. I taught for 5 years before I was married, and then taught for another 5 years before we had children.

When we had children, we transitioned to one income so I could stay home with our children. In doing so, our income was cut by 48%. Needless to say, it’s been a challenging adventure but also a worthwhile one.

Here’s what I’ve learned about living on one income.

1. Living on one income takes planning.

Preparing to live on one income takes time and careful planning. There are certainly families who find themselves living on one income without any advance warning. This is an additional challenge but not an insurmountable one. For most of us, however, the transition to one income comes with a bit of time.

If you want to live on one income, do whatever you can right now to save money and cut expenses.

Many families start living on one income and saving the other one, long before they make the transition. This gives you time to adjust to living on one income while you are still earning another one to save and pay down debt. Make a plan of what you want to do with your income to prepare for when it is reduced.

My husband and I planned (even before we were married) that when we had children, I would stay home with them. We planned ahead by buying a house we could afford on one income and paying off all our other debt. When we became pregnant, we looked at our plan again, made sure we had money set aside in our emergency fund and reworked out budget yet again.

That leads to the next lesson I’ve learned.

2. Living on income calls for a very carefully constructed budget.

You need to make every penny count when you are living on one income. Whether you have kept a budget in the past or not, you need one now! You need to know exactly where every penny of your one paycheck is going. You need to have money allocated for your monthly bills as well as the occasional ones.

There are countless ways to write a budget and many different programs to use. It doesn’t matter how you create your budget, it simply matters that you figure out your budget now. You can’t count on an extra salary to cover unexpected expenses anymore!

Once you’ve created a budget, you will need to review it regularly for any expenses that may change. I am always looking for ways to reduce our expenses and find more room in our budget. I consider it my job to help our family by following our budget and saving us money however I can.

3. Living on one income requires sacrifices.

I’m not going to lie. Living on one income is not easy and it does require sacrifices. The sacrifices aren’t always fun but when you are committed to living on income, you make the sacrifices.

- You may have to pause investments for a time.

- You will probably pay down your mortgage more slowly.

- You have to save longer for big house projects which means it may be months (or years) before you tackle what’s on your to-do list.

- You will drive a used car and wear hand-me-downs.

- You will stay home more and skip extravagant outings.

Perhaps you (like me) already do all those things. You might find yourself wondering if it is possible to pinch your budget even further. It usually is! It’s one of the reasons I love Kalyn’s new book 31 Days to Radically Reduce Your Expenses because it looks at areas everyone wants to cut and provides actual steps you can use.

4. Living on one income encourages creativity.

When you can’t spend money as freely as you did with two incomes, you find yourself being more creative.

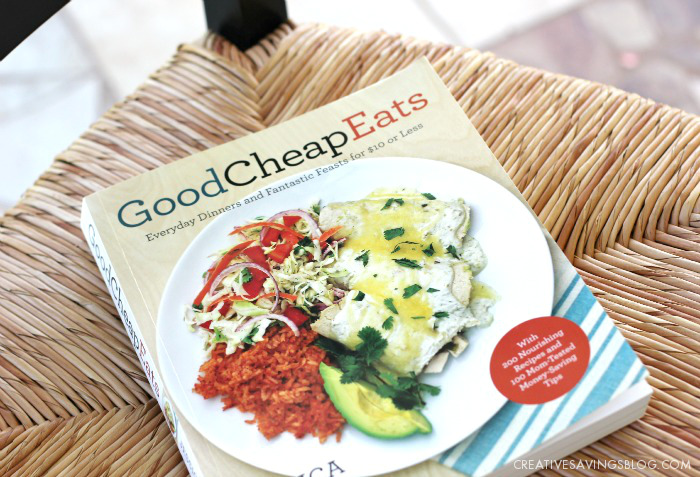

When it comes to food, you have to learn to shop on sale. You’ll cook from what is in your pantry. You will watch for mark-downs and build a stockpile. You’ll use coupons and eat your leftovers. You will learn to cook from scratch to save more money. For example, I learned how to make my own yogurt in a slow cooker. Not only is it easy and delicious, but it saves us money every single month.

If you want to travel, you’ll figure out ways to make it happen. You will drive instead of fly and stay with family or friends instead of in hotels. You will pack snacks and meals to eat in the car. You’ll use coupons when you eat out. You will join rewards programs to accumulate travel rewards.

You will learn to shop thrift stores and garage sales to stretch your hard-earned money. You will plan creative date nights and learn that you can have fun together without spending money. You might be surprised at how creative you become when your money is more limited!

5. Living on one income is possible

Finally, know that living on income is possible! It’s certainly not easy but it is completely doable. I am living proof of this fact! My family is not wealthy but neither are we living in poverty. When you make the choice to live on one income, commit to it wholeheartedly. Work hard, watch your pennies and live your life!

If you are living on one income, what lessons have you learned? What can you share to encourage others who hope to live on one income someday?

Kristen lives on one income with her husband, Andy, and their two young children. She writes at Joyfully Thriving about how she is learning to love her frugal life and encourages others to do the same. Kristen loves reading books, baking with chocolate and finding new ways to save her family money.

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

I need ideas to work from home as I have a recent disability and rely only on one income. My husband and I are raising three boys and need ideas. Also on budgeting to feed my family and save at the same time. Thank you.

We have lived off one income the entire time we’ve been married ( coming up 15 years), your so right! I grow a garden, make my own cleaning supplies and laundry soap ( which has saved us over 200 dollars a year! ) , I’ve been learning how to can and dry my own herbs! I work hard as a stay at home mom to do what I can to save money! I found I have a knack for baking bread! We have taken in my niece and nephew so our budget is stretched even thinner! , I try to earn gift cards doing surveys and stuff to help with our Christmas budget! Last year I did 1/2 of our Christmas shopping off gift cards! I’m happy to live off one income! I feel blessed to be able to do what I can!

And one more thing that is huge.. We also still give to the church!

Hi Kristen,

I can’t agree with your post more. I’m an accountant and when my first child was 14 months old, we knew God was calling me to be home full time despite the 43% loss in income and at the time, a high mortgage payment for a small home. We had to trust God was in control because a week after I finished working, we found out I was pregnant with my daughter! Since then..11 months ago, we sold our home at a profit, bought a larger home for 40k less than what we sold our home for and my hard working husband has increased his pay by 18%!! It’s still not easy with a home and two children under 2 as well, but I am super strict with meal planning, shop sales, clearance and a really limit the extras in life. We don’t have cable TV or smart phones and we don’t miss it at all. we still put money in our 401k and a little in savings, pay for house projects a little at a time(can’t wait for a new kitchen some day!!) And we can still treat ourselves or the kids to something special on occasion. I will never look back and never trade these precious years with my children for more things of this world!! Thank you for being a stay at home advocate and getting the word out there to those who think they can’t…I was one who thought not possible, but it is!!!!! God will always provide?

We live on one income even though we are a two income household. It’s one of the best decisions we’ve made hands down. We both work, so one paycheck goes to expenses and the other goes straight to savings!

That is so smart, Lindsey! Well done! Having that money in savings, and being accustomed to living on one income right now, will only help you in the future. Hands down, a great decision!

I love this post! As a financial planner and blogger, I believe it’s important, if not critical, to evaluate what your financial future will look like before making big decisions that affect your financial life.

Thanks, Natalie! I agree that it is critical to plan ahead…and it’s nice to have a financial planner back me up on that!