Say Goodbye to Financial Anxiety

This post may contain affiliate links. Read my full disclosure policy here.

Take a moment and see if any of these statements resonate with you:

- You earned significantly less income last month, and now you’re wondering how you’ll ever pay all the bills.

- An expensive appliance suddenly stops working, and you didn’t anticipate having to buy another one. Where will you find extra money for that?

- Retirement is looming closer and you’re not sure you’ll have enough to live comfortably, let alone cover all your expenses.

- Or one of my absolute favorites….Ahem…..the renovations that reveal more problems than you could have ever imagined. Now you’re in way over your head and still have to fix them, making your project cost more than double to finish.

It’s enough to cause a financial anxiety attack, yes??

Maybe you think you’re struggling through these kinds of feelings alone, but let me assure you that you are most definitely not. A recent survey by SunTrust Bank found that 70% of Americans are financially stressed and 80% say their personal finances keep them awake at night.

Personally, I think money {or a general lack of it} makes us feel like we don’t have control anymore, and that’s why we’re always so stressed about it. It ebbs and flows with our income and expenses, and a quick turn in the wrong direction makes us feel entirely helpless and insecure.

But what if I said you actually did have control? Because you have more say over your money than you might think.

From now on, I want you to stop seeing money as source of stress, and instead, view it as an amazing opportunity to improve and achieve the life you really want. But the first step is to figure out exactly what is causing that anxiety in the first place, address it head on, and move forward with a plan in place to reverse it.

When You’re Stressed About Paying Your Monthly Bills….

Step 1: Cut expenses wherever you can.

Maybe you’ve already cut costs and made huge sacrifices in this area, but I’m a firm believer there’s always more you can do. Dig deeper into your finances and find even more non-necessities that you can cut temporarily, or eliminate completely. I actually wrote an entire series on this called 31 Days to Radically Reduce Your Expenses, with hundreds of ideas to spend less, and save more. Many readers have gone through this series and saved hundreds, even thousands, on their monthly bills!

Step 2: Start a budget, or rework the one you already have.

If you’re new to budgeting, go through The Beginner’s Guide to Budgeting series and learn how to start a budget from scratch, or you can use it as a reminder to audit the budget you currently have. Figure out what’s not working and change it right away, using the core principles I outline each day in this in-depth series. Then keep track of your spending every week so you always know how much you should and should not spend.

Step 3: Earn more income.

When you’ve cut everything you can, and still don’t have enough to pay upcoming bills, it’s time to bring in a little more income. Look for unique side hustles and ways to earn extra money from home. Consider getting another part-time job that’s still flexible with your current schedule. Declutter your home and get familiar with how to sell on Craigslist and Yard Sale Facebook Groups. When it gets hard, remember…..this is only until you can get back on your feet again.

You should also read: How to Make Money as a Virtual Assistant and 5 Surprising Items to Rent for Extra Cash

When You’re Stressed About An Unexpected Expense….

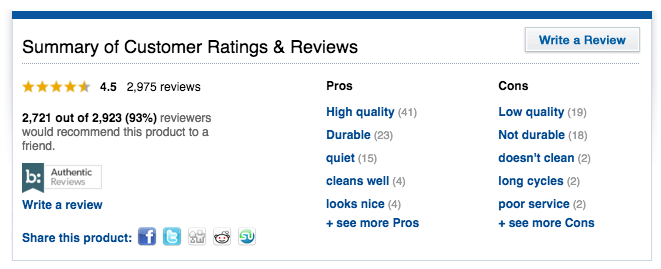

Step 1: Compare prices and shop around.

When something unexpected happens, our initial instinct is to get it fixed right away. This does not mean you ignore the issue, because some things {like mold} you just don’t mess with, but don’t let panic overpower your ability to reason either. Call a few different companies, read product reviews, and be very sure that you’re paying a reasonable price for a quality product or service before you commit.

Step 2: Request a payment plan.

Anytime Joseph or I have encountered an expense we didn’t expect, or didn’t have enough money stashed away for, we talk to the company to arrange a payment plan ahead of time. Most businesses are very willing to work with you provided you give them a down payment, after which they’ll roll the remaining balance into an interest-free or very low interest payment plan. No, it’s not ideal to have more debt attached to your name, but it’s definitely better than putting it on a high interest credit card!

Step 3: Build an emergency fund.

An emergency fund prevents panic from an unexpected expense from happening in the first place…and believe me, it will happen! While this probably sounds extremely negative, the key is to be prepared for these things as much as possible. I’d encourage you to start your emergency fund with a goal of at least $1,000, then when you become more financially stable, you can increase that amount little by little. If you’re not sure where to find the money to build your Emergency Fund, learn how we did it in 90 days.

When You’re Stressed About Retirement….

Step 1: Set a goal, and outline the steps to reach it.

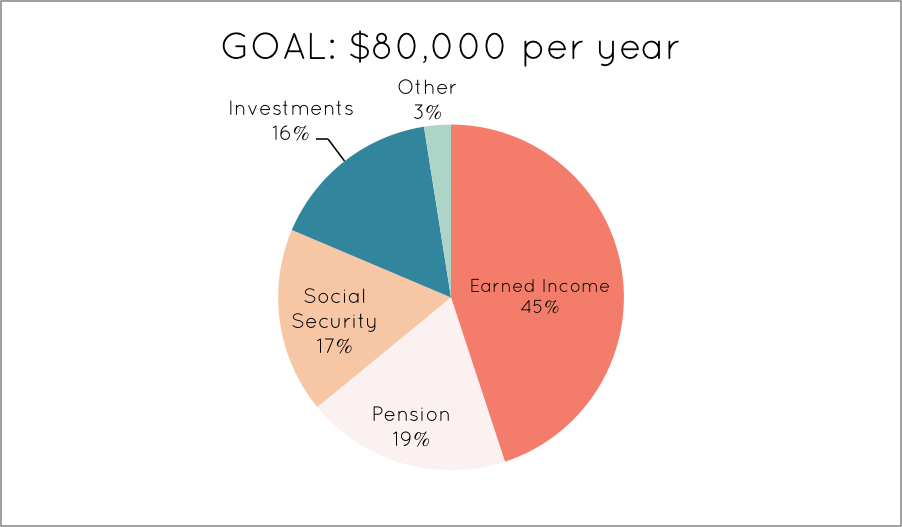

One thing I’ve learned over the years is that you will rarely meet your goals without a concrete step-by-step plan. Take time to sit down with the exact amount you could live on each year {aim a littler higher to make room for unexpected expenses}, then create a pie chart with various streams of income, and how much you need in each income stream to meet your yearly goal. Make it tangible, then outline action steps to achieve those exact income amounts.

Step 2: Cut your cost of living.

Much like those who have a hard time making their monthly bill payments, you need to be careful about how much you currently spend in a year and look for ways you can easily cut back. Think about what are truly a necessity and what you can get by without. You may need to downsize to a smaller home, negotiate with utility providers, and even cut your landline or cable phone for a few months or indefinitely. Again, my 31 Days to Radically Reduce Your Expenses series is essential to achieve this.

Step 3: Earn more income.

If you don’t have enough income to currently support your retirement goal, it’s time to think outside the box and bring in more money. Depending on age, consider getting a different, higher paying job with better benefits. Look for ways to make money from home and online. Comb through the rooms in your house, and part with items you don’t need anymore or are just taking up clutter. Be diligent in looking for these opportunities now, so you don’t find yourself in big trouble later.

Each of these steps gives you one very important thing — financial breathing room. And when you have more breathing room, you worry less and feel more in control. Feeling in control will inspire you to save for your goals, and when you know what you’re saving for, you have the freedom to spend intentionally on what matters most.

It’s a domino effect with the BEST consequences, yet it starts with that very first step –acknowledging your source of stress, then creating an action plan to help conquer it.

I can’t wait to see you take control of your finances and focus on the moments that really matter. You deserve it!

What about your finances keeps you awake at night?

Want more tips for how to manage money better? Check out this page for 60+ more tips!

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

This is a sponsored conversation written by me on behalf of SunTrust. The opinions and text are all mine.

I really like this article. The statement you made about “thinking about money as a way to achieve what you want in life” is completely empowering. Beautiful statement. Thanks for posting so many great tips!

Thank you, Becky. It’s so difficult for many to have that positive relationship with money.

I always felt like I was the only that totally lost my cool over money stuff. I’m slowly working my way to more confidence with money, but I spent a long time feeling very helpless about money. Thank you for writing this post.

You are most certainly not alone, Marislynn! I’m glad you found this encouraging. Getting rid of the anxiety can be a long journey but you can do it and I promise you that it is very rewarding!

Well written! The anxiety doesn’t have to be felt. Perfect example. My husband and I just filed our taxes last night and realized our income has dropped 46% in the past 2 years, since I started staying home with our son. (And we weren’t making a lot before!) Still, we’re able to pay all our bills and tuck money away in savings, travel and save for retirement. We’re not doing it as quickly or as much as we were before, but we get creative and earn extra money when we need it. It’s another reminder that God always provides!

What an amazing story, Kristen! Thanks for sharing. I’m pretty sure there will be many occasions when I am going to come back to this post to remind myself to let go of the anxiety and embrace action!