The Spender vs. The Saver: How to Coexist When You’re Complete Opposites

This post may contain affiliate links. Read my full disclosure policy here.

Ever since 6th grade, I knew I wanted to marry my now-husband, Joseph. It started out as a silly school-girl crush, but turned into hundreds of diary entries by the time I entered high school. Imagine my over-the-moon excitement when he finally looked my way!

However, there was a time when I seriously second-guessed our relationship. We were both working at Summer camp, and talked at length about the possibility of marriage. The subject of finances was brought up, and quickly spiraled into a reveal session that totally through me for a loop.

There was $41 in his checking account, and absolutely no savings. Nada. Zero. Zilch. Get my drift?

I realized then just how much of a spender he was. I didn’t love him any less, but I knew if we were to move forward in our relationship, we had to nail down a system that would pay our bills, build savings, and work for both of us.

I have to tell you—as total opposites, it sure wasn’t easy finding common ground. In fact, we still have quite a few setbacks! But over the past nine years of marriage, we’ve also learned how to communicate more effectively and make financials decisions that help us both thrive.

So no matter where you fall on the Saver vs. Spender spectrum, I want to share five critical “rules” that have kept money disagreements from ruining my own marriage.

1. Accept Who They Are

I’m convinced more than ever that you can’t turn a Spender into a Saver and vice versa. You can install good habits, but when it comes down to it, this is simply something that is just ingrained in our DNA! So instead of fighting the way your spouse is, focus on their good qualities—the ones you fell in love with in the first place.

For instance, one trait that attracted me to Joseph was his generosity. He was the person who always offered to pay for dinner with friends. He also loved helping others with house projects and car rides, no matter if he got paid for labor or gas.

While I feared people would take advantage of him, I’m still thankful I have such a thoughtful and caring husband. I love him for it, and try to work with this aspect of his personality, instead of constantly create arguments surrounding it.

2. Work Together Towards a Common Goal

Have you ever talked with your spouse about what goals you have for your money? I mean, really talked?

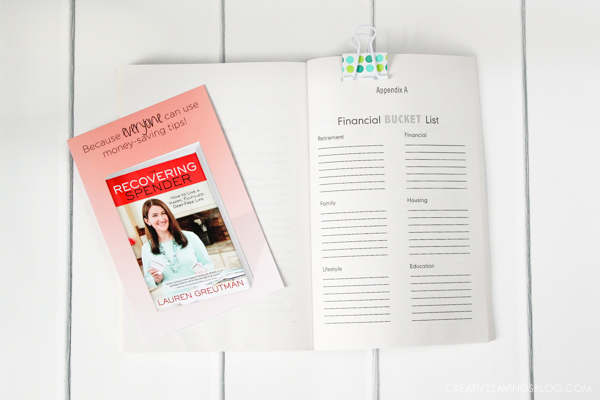

I recently read The Recovering Spender by Lauren Greutman, and I loved her suggestion to create a Financial Bucket List. This helps realign your values as a couple, and outline what goals you want to both accomplish.

Lauren suggests you each create a Financial Bucket List separately, then go over your answers together. This provides you with a variety of talking points and will open the lines of communication about where you want to spend your money.

3. Stay in Constant Communication

Speaking of communication, this step is crucial to maintain any sort of healthy financial relationship. Remember, you are a team, so you have to let each other know what’s going on!

- As a Spender, it’s your responsibility to keep your spouse up to date with receipts and anything you need to buy that day or week.

- As a Saver, it’s your responsibility keep your spouse up to date on which expenses need to be worked on, and a general financial overview so they’re not kept in the dark.

One thing that really helps with this are Budget Meetings. It doesn’t have to be a formal get-together or anything—10 minutes a week should suffice. These “meetings” are a great way to keep each other accountable and talk about what’s working and what’s not.

4. Allow Freedom Within Limits

I’m a firm believer money should be shared in marriage, but it’s also healthy to have a slush fund for each person in the relationship. Both Joseph and I have “fun money”, and designate a specific amount every paycheck to fund this category.

Basically, this money is totally unaccounted for, and we can decide where to spend it without the approval of the other person. Not only does it relieve the pressure, it also allows each of us to buy something we wouldn’t normally buy…and get away with it!

You might only be able to afford $5-$10 every paycheck to start. That’s okay. Our budget is tight enough where we can’t do much more than that either. But it’s still fun to save up for a special treat, regardless of how long it takes.

5. Offer Forgiveness and Understanding

Lastly, remember neither one of you is perfect. There are going to be financial screw ups on both sides, no matter how responsible you are! For instance, there’s been times when I’ve forgotten to pay a bill and incurred a late fee, or Joseph grabs takeout when we have no money left in our food budget.

Things like this are bound to happen. The real test is in how you respond to it.

In The Recovering Spender, Lauren shares the defining moment when she confessed to her husband about the $40,000 debt she had accumulated in various loans and credit cards. Although he knew they were in financial trouble, he didn’t know the extent of the damage.

What could have been a drag out fight, was actually the start of a much-needed change. In fact, when Mark saw how much trouble they were in, his response was not one of anger or frustration. It was, “I forgive you. Let’s get out of this together.” These words gave Lauren the confidence she needed to change her spending addition and heal from a lifetime of unwise choices.

Just think…how much better would our marriages be if we forgave financial mistakes, rather than held them against our spouse? I think quite a bit.

To be honest, I didn’t think I would get anything out of it because I’m such a die-hard saver. But I enjoyed the book SO much, I now have a list of ideas I can’t wait to implement myself!

The book is divided into two sections—one covers Lauren’s own financial story and the other offers loads of practical tips to create a Recovering Spending Plan for yourself. Yes, even if you think you’re a pretty darn good saver.

I promise you won’t regret putting this gem on your bookshelf! Learn more about The Recovering Spender HERE.

Are you more of a Saver or a Spender?

Want more tips for how to manage money better? Check out this page for 60+ more tips!

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

This is my husband and I as well. I’m the saver in our relationship too. The nice thing about the balance is that he reminds me (on occasion) that money is just money. It’s a tool and there are times we can choose to spend it. It’s a balancing act! I’m adding this book to my book list.

My boyfriend is a saver and i am not. It’s such a shame because I want to be so bad! Then we walk into a place like World Market and there are 4 “paint your own” sugar skull ceramic banks & I got the “eye” when I picked up 3, then put them all down except for 1. Haha, I’m working on it! Goals in savings are always a good idea and i’ve got the goal to get rid of my credit card debt by this time next year.

Oh I’m so familiar with “the eye.” Usually because I’m the one giving it :). Keep working hard at that debt! One thing that motivates my spender husband is looking at the extra money that will suddenly be “appearing” in our budget when a debt is paid off. Then, of course, he starts imagining what we’ll be able to spend it on and I imagine what we should save it for. 😉

We have the same type of relationship! He is the spender and I am the saver. We work great together. He reminds me that it’s okay to spend money on things we need, and I make sure we are saving toward our goals.

It can be such a huge advantage to have the separate perspective!