When Is It Really Worth It to Buy Name Brand?

When comparing generic vs. non generic brands, cheaper does not always mean the same quality. These seven items are proof that you may need to spend more up front to spend less later!

Join 23,000 Type-A's who get mindful productivity tips in their inbox.

When comparing generic vs. non generic brands, cheaper does not always mean the same quality. These seven items are proof that you may need to spend more up front to spend less later!

Get ready to book your next bucket list destination! From picking the place, reserving lodging, and creating a customized itinerary, this step-by-step guide will help you plan a memorable and stress-free travel experience.

This essential mindset will totally transform your relationship with money. Now you can spend less on the things that don’t matter as much in exchange for the things that do!

Whether you’re new to budgets or you’re a budget pro who wants to change it up, here are 7 budgeting programs you need to try! Warning: you might even find that budgeting can be fun!

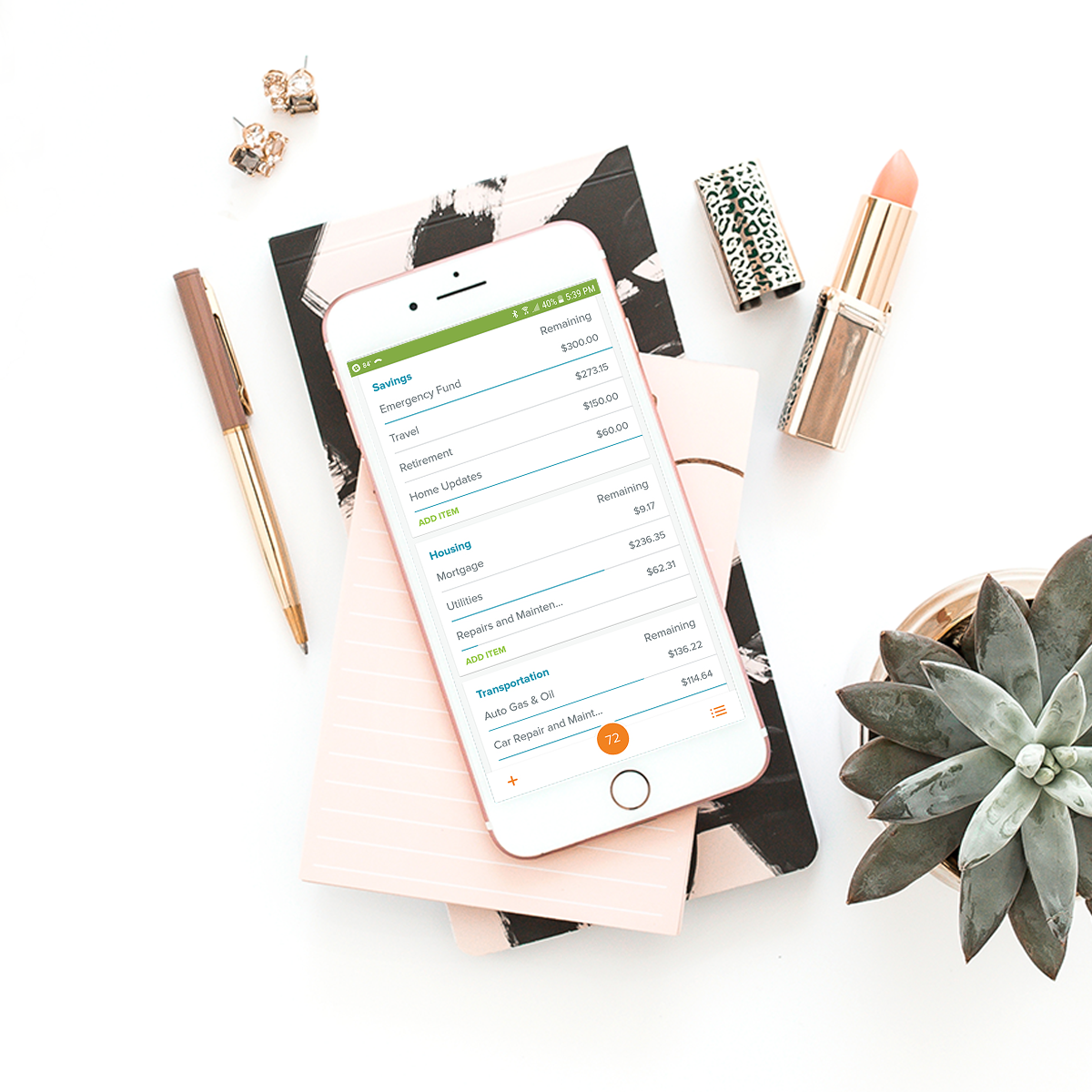

Budgeting tools have the power to change your financial future, but which one is the best tool for the job? Find out the pros—and cons—of Dave Ramsey’s popular app in this comprehensive Everydollar review!

Find every receipt quickly and easily with this simple three step system to process your purchases from start to finish. You’ll finally eliminate paper clutter in your purse, wallet, and countertops and be meticulously organized come tax time!

Mistakes in life can lead to financial disaster, but if you follow this step-by-step financial advice for your 30s, you’ll quickly find yourself back on track. You especially don’t want to overlook #9!

Does managing your money, bank accounts, investments, and/or debt payments ever make you feel overwhelmed? It doesn’t have to! These simple finance tips inspire you to pare down to the absolute basics. Let’s stop making money so darn complicated!

This ONE simple switch completely revolutionized my finances. In fact, I stopped going over budget once and for all! Learn more about the purse-sized tool I credit to my continuing success, and why I’m convinced it’s a total game-changer.

Having a healthy savings is essential to your financial well-being! Here are 3 surefire ways to increase your savings account so you can afford the things that matter most, and be prepared for what lies ahead. #2 is super motivating and will make sure you stay on track!

Use all the basic principles in the Beginners Guide to Budgeting Series and take your budget to the next level with this fantastic tool! The monthly and yearly overview combines all the previous printables and spreadsheets into one end-of-year statement that will help you budget even better.

Although it might seem impossible to budget on irregular income, it`s actually even more essential that you do. Those in contracting, self-employment, or commission based jobs MUST read this post to discover the 3 tricks to a recreate a steady paycheck and discover financial security!

Did you spend much more than your budget could handle last Christmas? Discover the secret to saving for this special Holiday with a free printable worksheet, and never worry about over-paying for gifts again!

Deciding when and where to travel for the Holidays can be financially exhausting! These tips help make Holiday travel much more affordable.