How to Reach Your Savings Goals in Your Sleep

You’ve probably heard of automatic savings apps before.

In short, they transfer money from your bank into an online savings account where you can’t easily access it, sometimes while earning a higher than normal interest rate.

To be honest, I used to shy away from these apps because it always felt like I was admitting my lack of discipline. Like I should know better and shouldn’t have to rely on an app to push me to save money. Simply put, I was embarrassed that I needed help!

But no matter how disciplined you try to be, savings apps are an extremely powerful way to take the temptation to spend out of your hands and move you closer toward achieving specific monetary goals than ever before.

How do I know?

Because after using one such app (the Rize money app, in particular), that’s exactly what it did for me.

My Rize Review: The Best Automatic Savings App Out There

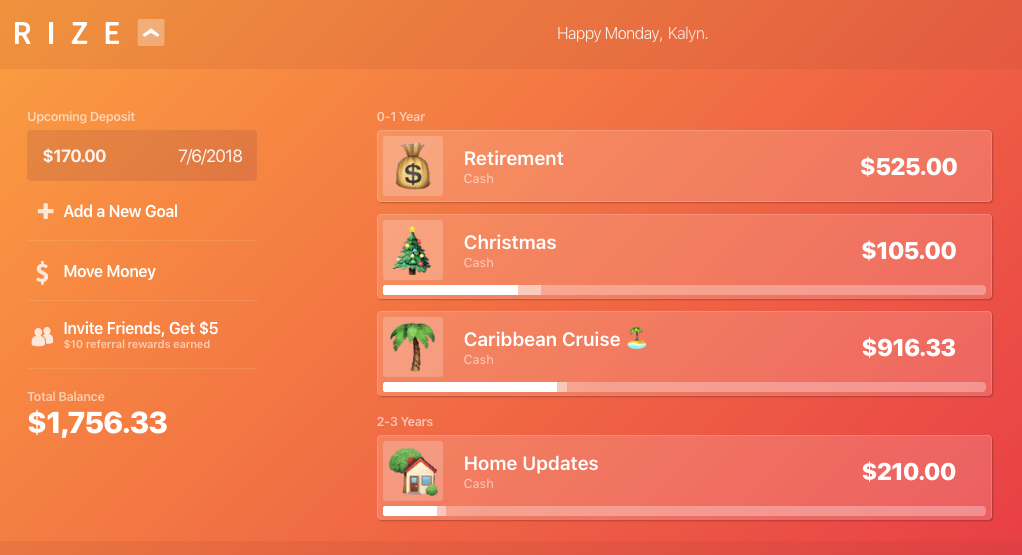

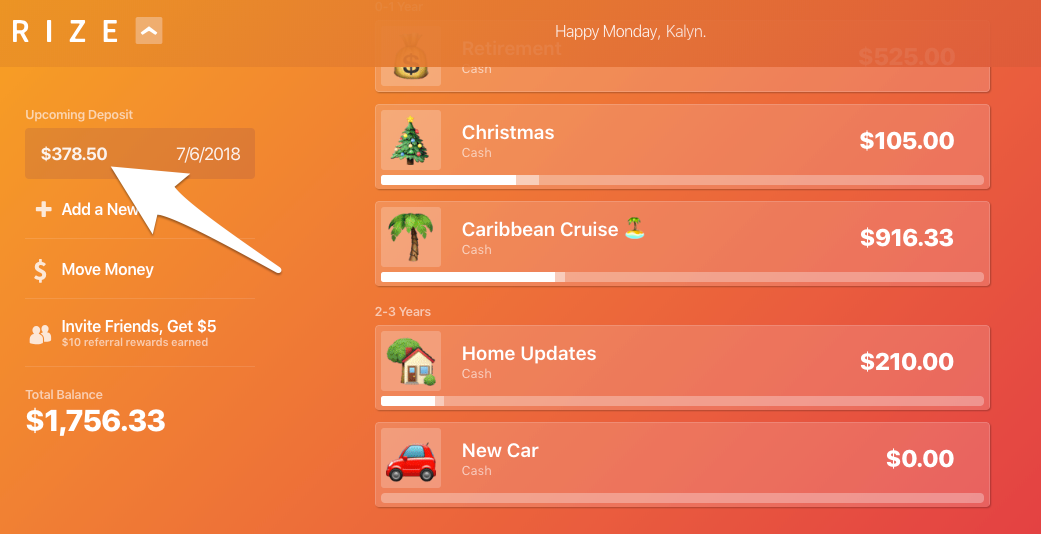

I’ve successfully used Rize over the past 10 months to save over $1,700. I barely had to lift a finger, and I hardly notice when the money leaves my checking account to be applied toward my current savings goals.

It’s not because I’m fortunate to be surrounded by money I don’t know what to do with (oh how I wish!). It’s the power of the app that makes saving money ridiculously easy.

Jump to…

Here’s what I love most about my Rize savings (besides the savings):

- The crazy high interest rate the Rize money app gives to you. As of June 2019, the interest rate was 1.16% APY. This compounds on the 15th of every month and deposits automatically into your account.

- It’s absolutely FREE to use. If you fall head over heels in love with Rize savings, you can set up a small monthly donation as a thank you, or continue to use it at no cost. (FYI: You need to contribute $2 per month if you use the investment features). Otherwise, there are no hidden fees or minimums like big banks often require.

- You choose how much you want to save and when. Other savings apps like Digit pull money out of your account based on your spending habits and what they “think” you can save. I don’t like giving over that much control. With Rize, I get to make all the decisions!

- You can skip a transfer (or pause them indefinitely). If money is tight one week and you need to take a break from saving, you can easily skip the next scheduled transfer with no problem, or pause all your transfers until you get back on your feet.

- It’s available as an Android or iPhone app. Check your savings totals on the go and make changes to your amounts wherever you are. This is especially handy when “budget dates” are more impromptu: often Joseph and I will talk about our financial goals while on road trips or while eating out at a restaurant. So I love that I can easily pull up Rize on my cell phone.

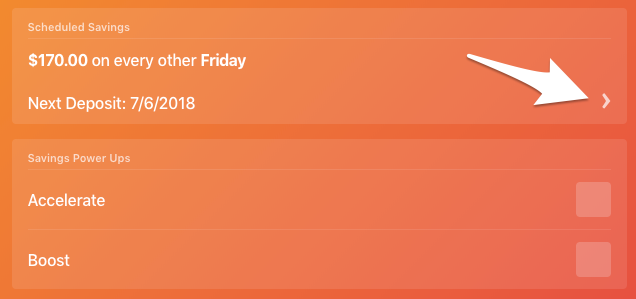

- You can use “Power Ups” to save even more. One is called Accelerate, which automatically increases your savings by 1% and Boost works similarly to Digit; it pulls spare change out of your checking account based on when you can afford it.

- Your money is SIPC protected up to $500,000. You’re probably used to seeing the term “FDIC insured,” which is typical for most bank accounts. However, Rize isn’t your typical bank account, which puts it under the SIPC umbrella. After some research, I’m convinced SIPC protection is just as safe (you can check it out for yourself here)…maybe even more so since it’s a non-profit corporation backing your money and not the government!

Two things I don’t love:

While I’ll proudly proclaim my love in this Rize review all over the internet, there are two things I wish were a little different.

- I wish the interface were easier to navigate. I find the dashboard to be a little clunky and it’s hard to find exactly what I’m looking for within a matter of seconds. I often click on buttons that I’m sure will take me where I need to go, and they take me someplace completely different! Hopefully this will be easily resolved in the future with a redesign.

- I wish more detailed activity statements were available. On your main activity statement, Rize lists how much interest you receive each month as well as your completed deposits, but doesn’t give you a detailed run-down for each of your savings goals. I guess this doesn’t matter too much, but I’d love to click on each category and see the individual activity rather one statement that covers everything.

Thankfully, the pros definitely outweigh the cons. I can deal with these two issues for the sake of all the other benefits Rize offers!

So, How Does Rize Actually Work?

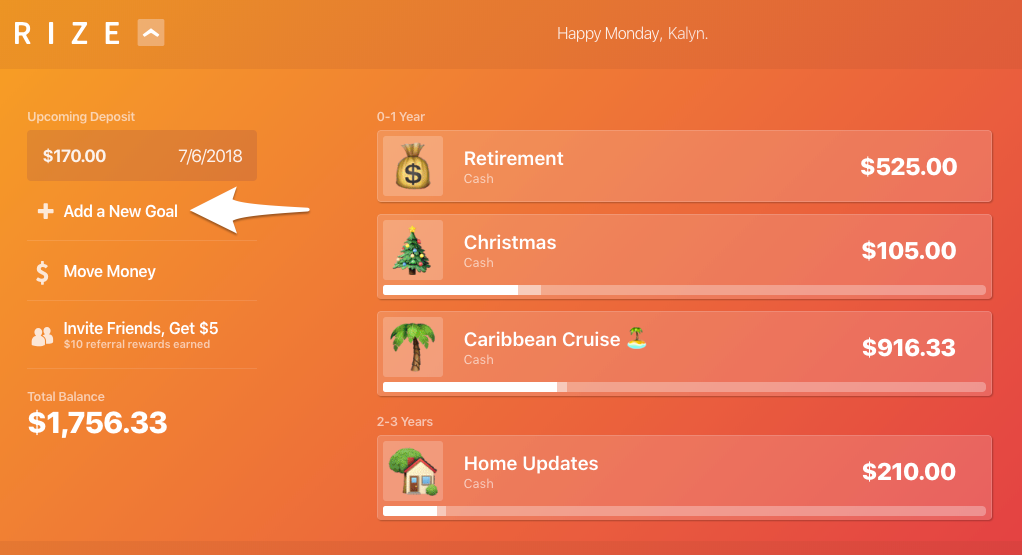

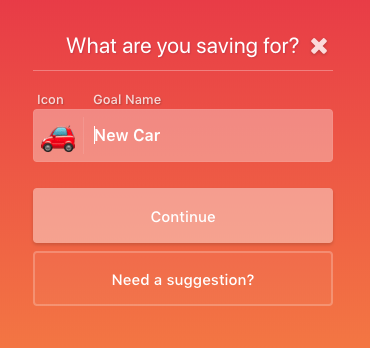

Now that you’re coming around to a Rize savings account being your budget’s new best friend, let me show you exactly how to get set up and navigate that potentially clunky dashboard I was talking about so we can skyrocket your savings goals.

1. First, sign up for a Rize account (you get $5 just for trying it out!) and set up at least one savings goal. You can do this by clicking on the “ADD A NEW GOAL” section.

Choose a name for your goal, then add a cute icon as a visual representation. These icons are totally not necessary, but aren’t they fun?!

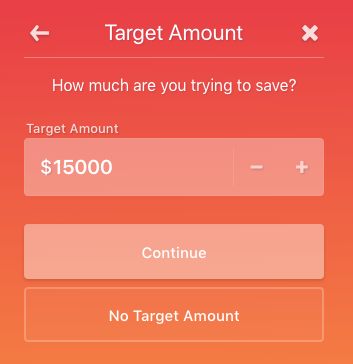

2. On the next screen, you’ll decide how much you want to save in TOTAL. For example, if you want to pay cash for your next car, enter the estimated total cost of that car. For the sake of this example, I typed in $15,000.

HEAD’S UP: If you don’t have a specific number in mind—for instance, if you were saving for general home repairs or retirement savings—then choose the option NO TARGET AMOUNT. You don’t need a total monetary goal to start saving!

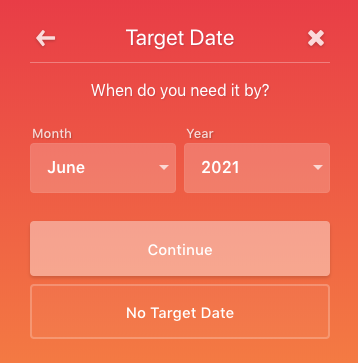

3. Choose a target date IF you want to have that amount saved by a specific time period. So if your current car is still in decent shape, you could choose a date 3 years from now. Or you could choose NO TARGET DATE if you don’t have a specific date in mind.

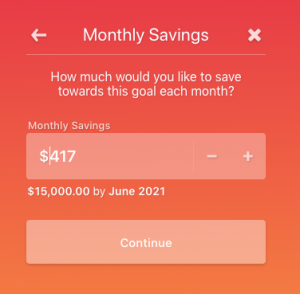

4. Rize will automatically tell you how much you need to save each month to meet your goal. If that’s too much to handle, adjust your amount or date as needed. If you don’t have a target amount or date, you’ll simply choose how much you want to put toward that category each month.

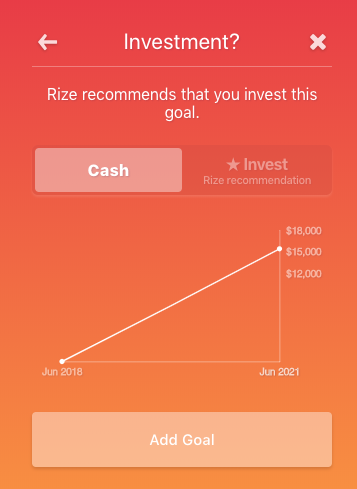

5. Once you click CONTINUE, Rize might recommend you invest your money. I haven’t explored their investment feature yet, so I can’t tell you with 100% confidence whether it’s worth it. I would skip that part for now and just choose CASH. Then click ADD GOAL.

6. Voila! Your new goal appears on your main dashboard and will automatically update with the total of your next upcoming deposit.

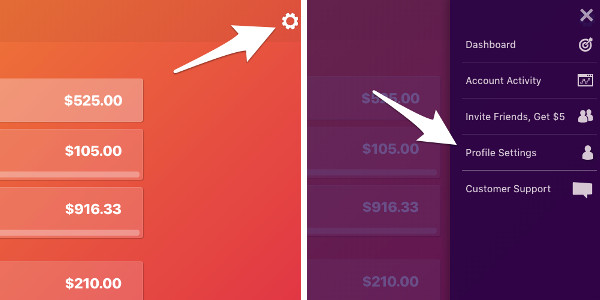

If you ever want to change your deposit schedule, click on the GEAR icon in the upper right hand corner of your desktop screen, then choose PROFILE SETTINGS.

Scroll down to where you see SCHEDULED SAVINGS. Click on that little arrow and update your schedule. Remember, you can always pause all transfers if you need to take a break for a little while!

What I never expected to happen

Every time I log into Rize, I’m blown away at how much closer we are to reaching our financial goals compared to the endless wishing I was doing earlier.

I also realized something else:

You can achieve WAY more than you think if you push yourself hard enough.

It’s easy to think that using an automatic savings app would be a lot easier and more enjoyable if you had extra money laying around that you “don’t know what to do with.”

But here’s a little secret: Using Rize is even more powerful when you have an already-tight budget—because it forces you to live on less.

That transfer every week or every two weeks is going happen (unless you log in and prevent it!), and when it does, it’s pretty extraordinary how easy it is to squeeze money out of places you never thought you could before (like your grocery budget, for instance!).

So here’s my challenge to you:

What savings goal can you not stop thinking about?

Is it a down payment for a new house? A kitchen remodel? An anniversary spent touring all your must-see spots on a romantic European vacation?

Dreaming about where you want your money to go is the easy part. Telling yourself “no” to a purchase now, in order to say “yes” to something else down the road requires a little reinforcement in the form of Rize.

Even a tiny $10 a week transfer into your Rize savings account is enough to start funding your goal. Once you see how little you miss that $10 a week, push yourself to increase it a little bit more and find creative ways to fill in the gaps. Psst… I wrote a book packed with ideas you might not have considered yet!

I want nothing more than to see you fund your dreams without worrying about all the drastic things you think you have to do in order to pay for them.

When Rize does the heavy lifting for you, you’ll quickly discover saving money isn’t all that hard…especially when you’ve got a secret tool in your back pocket to take you exactly where you want to go.

Let’s chat:

Have you ever tried an automatic savings app before? What is one savings goal you have that would be absolutely perfect to fund using Rize?

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

Thanks for introducing me to this beautiful and efficient app!

Really looking forward to use it.

It is seriously our families favorite savings app!

Hi Kalyn.

First – let me say how much I love you!!!! When I’m feeling a bit overwhelmed, I go to your site for tips on just about everything! Thank you!! (I especially love the bullet journals!)

Second, I signed up for Rize Money and got it all set up… I love this app and the savings accountability it provides. However, I didn’t get my $5 for signing up – which makes me wonder if they somehow didn’t connect me to your referral. I’m not sure if you also get an incentive as well, but I wouldn’t want you to miss out on that. Let me know.

Hi Esther,

Thanks so much for the encouragement!

No worries on this end. 🙂 Generally it can take up to 30 days for Rize to put the $5 in your account so keep you eyes open for it. If you don’t receive it be sure to reach out to their customer support!

Someone turned me on to Qapital app that does the same. I am always amazed of what I’ve been able to save up and pay for instead of having to beg to borrow money. I hadn’t managed a huge amount of savings but the unexpected expenditures that have come up I’ve been able to save up for and cover. Hoping those stop soon and I can really start saving.

I totally understand how those unexpected expenditures can really deflate the feeling of savings, BUT remember, if you’re not begging and borrowing money for those, then you have actually been saving money! So you really have started saving. Now hopefully it will start building up for you too. 🙂

Surrounding yourself with friends or family members who support your goals can boost your confidence, remind you why you’re saving and buoy your enthusiasm if setbacks occur.

That’s so true, Sarah!