What to Do When Your Credit Card is Stolen

This post is sponsored by Discover, however, all opinions and experience with a stolen credit card is 100% mine.

This post may contain affiliate links. Read my full disclosure policy here.

Me: “Um……Joseph? Did you buy airline miles from United? Like, $1,000 worth??

Joseph: “No……why?”

Me, in an escalated state of panic: “Then I think our credit card was just hacked!!”

For the first time in my life, my credit card information was in the hands of someone who thought an unauthorized shopping spree was perfectly acceptable. And for a few seconds, I felt entirely helpless.

What if we’re ultimately responsible for this amount? What if this guy is right in the middle of charging something else to our card? Oh my goodness, we have to call our credit card company RIGHT NOW!

Thankfully, our charges were immediately reversed. But while the credit card company is still filing reports and trying to pin down this tactless individual, this entire experience reminded me how easy it is for our financial information to fall into the wrong hands.

As much as we all try to be careful, hackers hack. They get a hold of our data with state-of-the-art skimming equipment, or in more recent news, security breaches from some of our favorite stores.

*Cough* Target. *Cough*

So often, a compromise like this can easily paralyze us with a sense of dread and panic, and for a few moments, we’re not quite sure what to do. But now’s the time when you need to act, and you need to act fast. If you were just hit with a notice of a stolen credit card, here’s 5 steps you need to take right away.

Psst….those of you who haven’t experienced this yet, bookmark or pin this post for future reference so you know exactly what to do if or when it does!

1. Identify All Fraudulent Charges

When you first log into your account and see that it’s been compromised, print out a list of the most recent transactions, and highlight or circle ALL fraudulent charges. Have this paper handy so when you call the credit card company, you don’t have to search for the information when they ask. You want to get everything taken care of as quickly as possible.

2. Call Your Credit Card Company

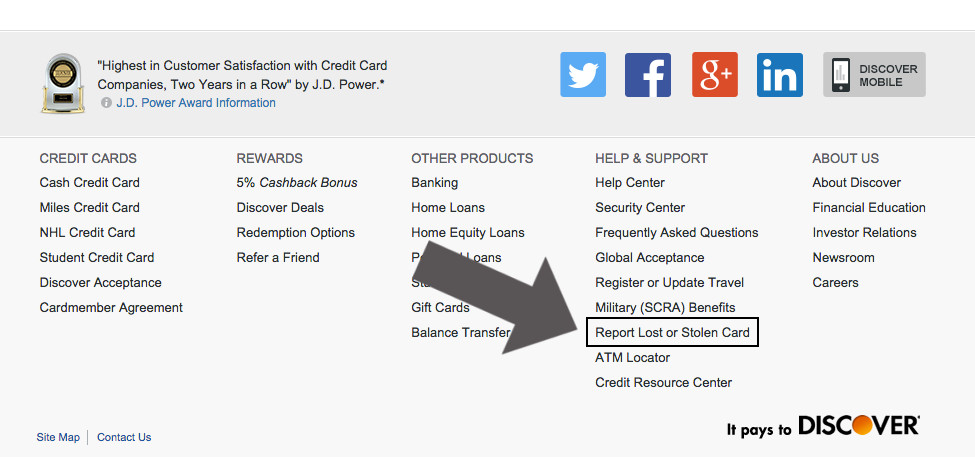

Next, find the right number to call. You don’t want to be on hold for hours or pressing an insane number of buttons to direct you to the right place. On Discover’s website, there is a Report Lost or Stolen Credit Card link towards the bottom that gives you the exact information you need. Remember to write down the exact time and date of your call, and who you talked to, just in case you need to reference it later.

One of the really cool features of Discover cards is the ability to “Freeze” your account whenever you misplace your card or have information stolen. You can do this online or via their mobile app, and it puts a hold on all future transactions. That way, if anyone tries to use the card, they will automatically be denied.

3. Contact a Credit Bureau

If your entire wallet was stolen, {and not just a credit card number}, it’s a good idea to also add a 90-day fraud alert to your credit report. This prevents the thief from opening other financial accounts in your name, and notifies lenders to take extra precautions that the person requesting a new account is actually you. The nice thing is, you only have to do this once. The first credit agency you contact is required by law to alert the other two on your behalf.

4. Change Monthly Charges Attached to Your Card

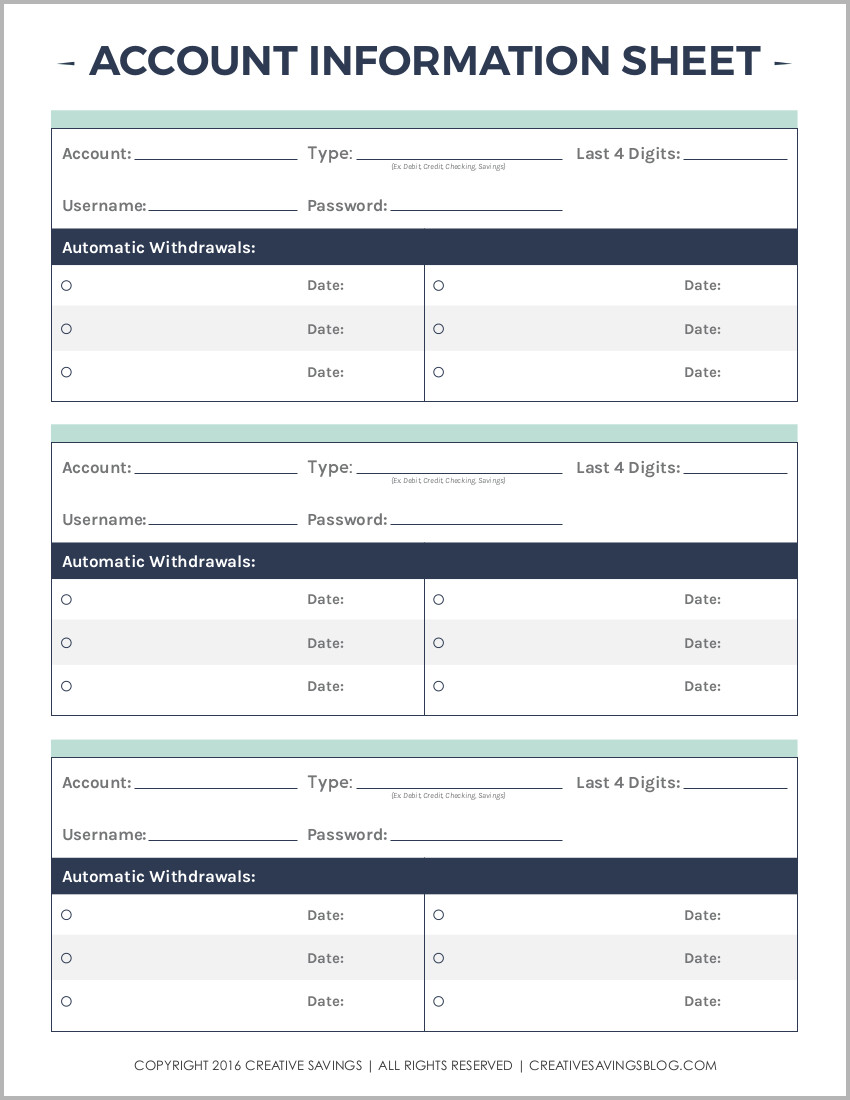

It’s frustrating enough to have your information stolen, but now comes the part where you have to change all monthly subscription charges and withdrawals that were attached to that same account. Depending on how many you have, this can be quite a task in itself! I use this printable to keep track of all my savings, checking, and credit card accounts so I always know what comes out where and when.

Download Account Information Sheet

5. Take Preventative Measures From Now On

Just because you’ve notified your credit card company and switched over all automatic withdrawals on your account, doesn’t mean you can breathe a sigh of relief just yet. Now it’s time to be even more diligent to make sure nothing like this happens ever again!

Here’s what I recommend:

- Check your statements regularly online, not just when you get them in your mail or email.

- Stay on top of your credit by requesting a FREE report every few months. Discover also provides your FICO® Credit Score for FREE on every monthly billing statement.

- Use a chip-enabled credit card like Discover, which creates a unique ID for every transaction.

- Create stronger passwords. {I am so bad at this, so this is now my #1 focus!}

- Shred paperwork you no longer need.

- Avoid shopping online with your smartphone, unless of course, you follow these safety tips first.

The next time you find out your credit card or other sensitive financial information has been stolen, remember — don’t panic, take the action steps I outlined above, and most of all, stay safe going forward!

Want more? Head on over to this page where I’ve compiled even more smart credit card tips as well as plenty of ideas for how to manage money better.

Have You Ever Had Your Credit Card Stolen?

Discover stands by their mission to help consumers spend smart and save more, by providing the best products and programs for their money. In addition to branded credit cards, Discover also offers private loans, checking and savings accounts, certificates of deposit, and money market accounts. You can learn more about Discover HERE.

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

how do I print the template so I can use in my binder

Hi Cathy, if you click the link in point #4 it will open the PDF for you. From there you can download or print as needed! Hope that helps.