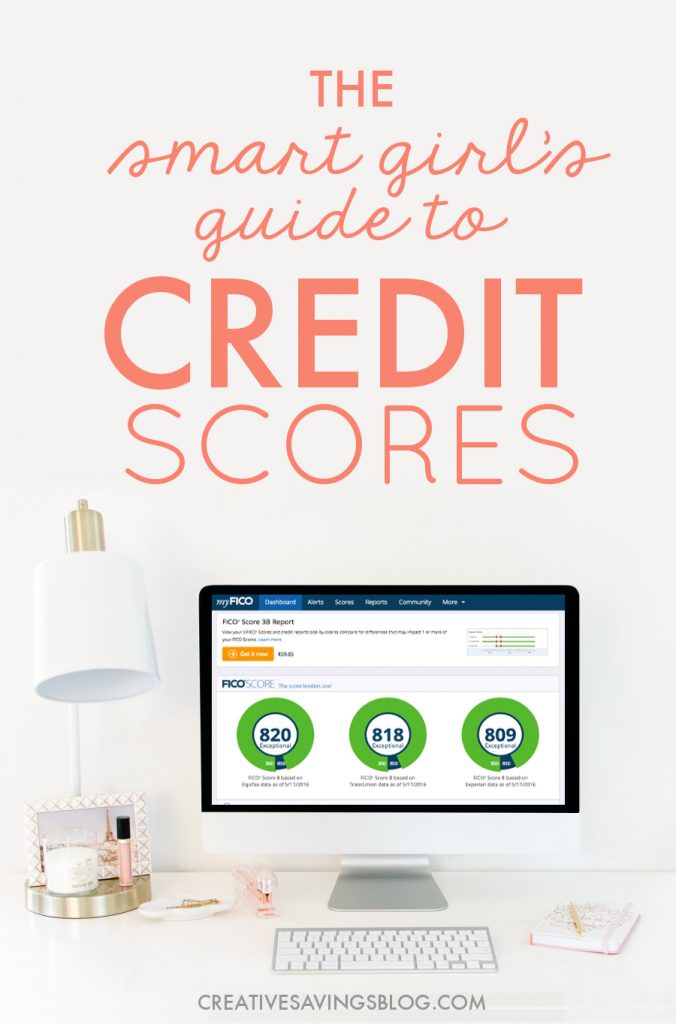

The Smart Girl’s Guide to Credit Scores

This post may contain affiliate links. Read my full disclosure policy here.

This post is sponsored by FICO, however all opinions and disagreements with Dave Ramsey over credit scores are 100% mine.

Instead, I’m more about the practical, down-to-earth ways to save a buck—like how to cut costs at the grocery store, or ways to decrease your monthly phone bill. But I also want to be knowledgeable about other aspects of my finances too.

The last few weeks I’ve been learning everything I can about credit scores so I know exactly how they work, what affects them, and answer the big question every Dave Ramsey fan is asking, “Does it really matter?”

Here’s what I found!

Psst…to make navigating this post a little easier, you can use this quick table of contents to find the information you need:

The Scoop on Credit Scores

Basically, your credit score is a “scorecard” used by banks and lending agencies to determine how likely you are to default on a loan. Scores range from 300 {bad} to 850 {out of this world amazing}. Obviously, the higher the score, the better!

There are three main credit bureaus—Experian, Equifax, and TransUnion—and an “accepted” credit score, also called your FICO® Score. Your FICO Scores are based on the information housed at the credit bureaus. The bureaus all work the same way, but usually the scores between them are different. This is because not all of your credit history is necessarily reported to all three bureaus.

NOTE: When applying for a mortgage or loan, you don’t get the option of which credit bureau they use. That means you want to make sure your scores from all three are good!

Now, I say accepted in quotes above because there are some companies who provide your score for free, but they don’t provide your FICO credit score. I had no idea there was even a difference, but apparently this is super important! In fact, when I tested it out, I found the free version quoted my score as 60-70 points less than FICO.

Here’s a list of authorized FICO retailers to ensure you are getting the correct score.

Why Your FICO Score is Important

Because your credit score is a snapshot of your likelihood to pay on a loan {like a car or mortgage}, it has a huge affect on the loan you can get.

For instance:

- An excellent credit score will give you a lower interest rate, thus saving you thousands in long-term interest. Yay!

- A bad credit score will give you a higher interest rate. Boo! It may also require an extra deposit or result in you being denied for a loan.

Loans aren’t the only thing impacted by your credit score though:

- Your landlord will probably check your credit score before he or she decides to rent to you. We never accept anyone in our NY rental without looking at credit scores first, and have denied tenants with too many outstanding balances and low scores.

- Insurance premiums can be based on credit scores in addition to your driving record. Yep, it’s true!

- If you want to earn decent rewards off a credit card, your score determines which ones you qualify for.

Overall, it affects a lot of important decisions…enough for me to say it’s better to have GOOD credit than none at all. So….why all the haters?

3 Misconceptions to Have “Good” Credit

Because credit scores work hand-in-hand with loans, they are often associated with debt. In fact, Dave Ramsey even calls credit scores an “I-Love-Debt” score. He’s certainly welcome to have that opinion, but I want to show you why that view is false.

1. You don’t need to carry debt to have good credit.

I recently saw a Youtuber say she wanted good credit, so she got a credit card to pay the minimum balance every month. I literally screamed “NOOOO!!!!” at the screen. This is why Ramsey has fuel for his fire—because we don’t really understand what it means to earn and maintain good credit!

Here’s the truth: You should never EVER incur thousands in credit card debt to “get” good credit. I treat my credit card like cash, pay my balance off every month, and have never paid interest in the past 10 years I’ve owned a card. This has resulted in a 800+ score.

Does this mean you can’t use a credit card to get a good credit history? Of course you can! You just don’t need to carry a balance from month to month. In fact….I beg you not to. When the bill comes, pay it. Pay it before it comes. Paying on time, in full, is great for your credit!

2. You don’t need to charge every expense to get good credit.

Guess what? You could literally put ONE charge on your credit card a month, pay it off, and that would be good enough for your credit. Charging more won’t necessarily help your credit score. Nope, not one bit!

Instead, I recommend you choose just one expense {like utilities or gas} to put on your credit card until you get used to paying off what you charge. This is also a good idea for those who are cash-only, but still want to have a good credit score.

>> More tips to build your credit score from scratch <<

3. More credit cards doesn’t necessarily give you better credit.

Credit scores take into account your available credit {how much unused credit you have} when calculating your score, which is also called your credit utilization rate. So while a variety of cards show your creditworthiness, you still don’t want to have too many.

Here’s why:

- For one, you’ll be tempted to use more of them and possibly rack up more debt than you can pay off. This negatively impacts your credit utilization rate, because the more you charge, the less available credit you’ll have.

- More credit applications result in more hard inquiries, which could also negatively impact your score.

So how many credit cards is too much? Well, I personally know someone who has sixteen credit cards and maintains excellent credit. But a good rule of thumb is only keep the credit cards you use regularly, and try to keep your balances low.

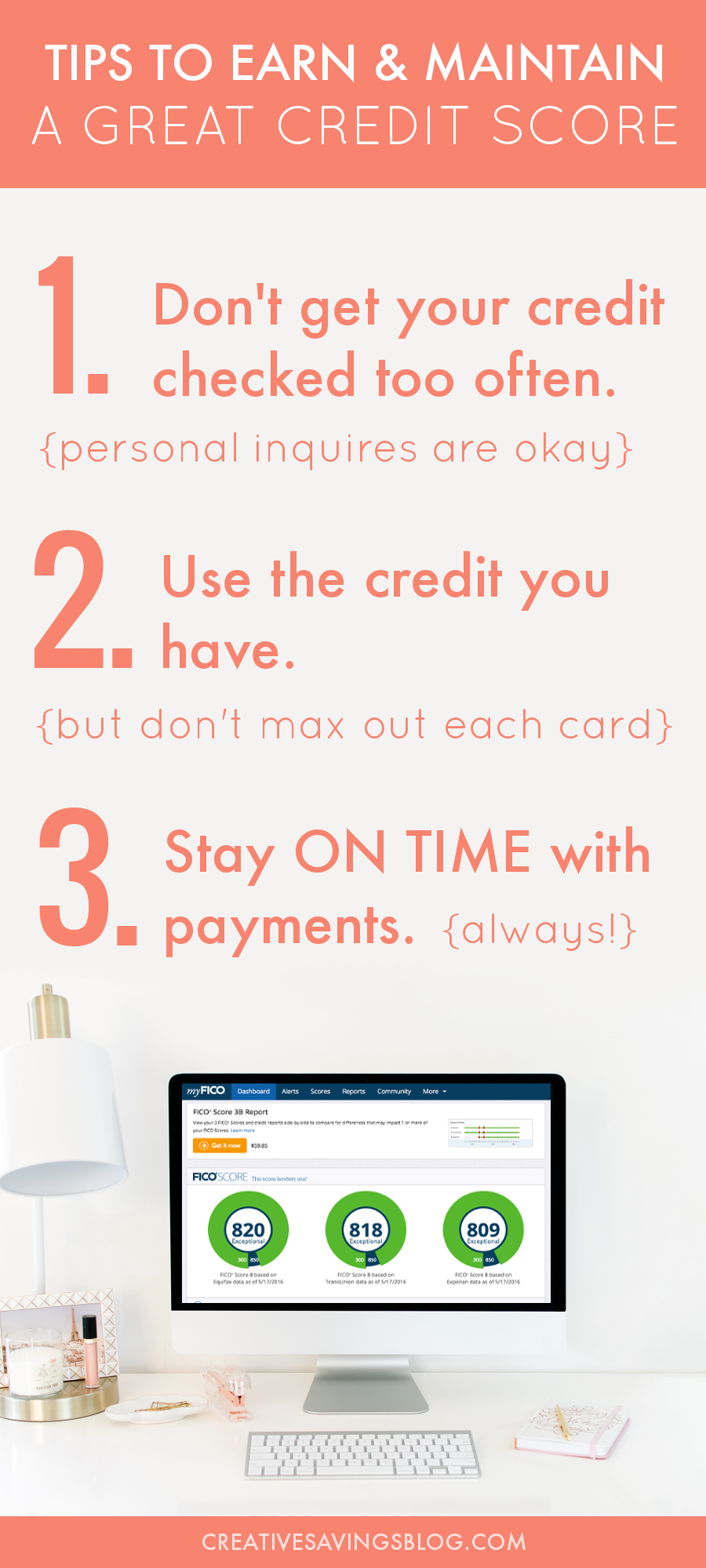

Tips to Earn and Maintain a Great Credit Score

So how do you earn and maintain a great credit score for years to come? Here’s three tried-and-true tips:

1. Avoid frequently applying for credit.

You shouldn’t be worried when the bank checks your credit for a car or home loan, but don’t get your credit checked needlessly {like for store credit cards}. Multiple inquiries give lenders a “head’s up” that you might have debt not yet reflected on your credit report. This, in turn, could impact whether or not they want to lend to you.

2. Use the credit you have.

Letting cards sit unused can increase the possibility of identity theft, however, you don’t want to max out your credit cards every month. Remember how I said lenders check your available credit? Hitting the max can hurt your credit, even if you pay it off each time.

3. Stay ON TIME with payments.

If you can’t pay your credit cards in full right now, cut them up, freeze them in water, lock them in a safe, or some other sort of drastic measure. Then get that debt paid off before ever considering using them again. Rewards are nice but they fall extremely short of the interest you are paying each month by carrying debt!

The Ultimate Question…

Of course, a GOOD credit score is important if you have one, but it begs this question, Do you really need one in the first place?

Yeah, I think you do. You *might* be able to get a mortgage without it, but like I mentioned before, there will be very strict strings tied to your loan. I think it’s much better to have an excellent credit score than none at all.

However, your credit score isn’t something you need to live and die by. I’m a huge believer that budgeting should be the FIRST step toward financial freedom—something you need to do before working on your credit!

What is your opinion on credit scores?

FICO is the company that invented FICO® Scores, which have been an important component of lender credit criteria for over 25 years. In fact, FICO® Scores are the credit scores used by 90% of top U.S. lenders. They make lending faster & fairer, giving consumers the ability to access credit and even save money on interest. Learn the real facts about FICO credit scores HERE.

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

FICO is the company that invented FICO® Scores, which have been an important component of lender credit criteria for over 25 years. In fact, FICO® Scores are the credit scores used by 90% of top U.S. lenders. They make lending faster & fairer, giving consumers the ability to access credit and even save money on interest. Learn the real facts about FICO credit scores HERE.

FICO is the company that invented FICO® Scores, which have been an important component of lender credit criteria for over 25 years. In fact, FICO® Scores are the credit scores used by 90% of top U.S. lenders. They make lending faster & fairer, giving consumers the ability to access credit and even save money on interest. Learn the real facts about FICO credit scores HERE.

My sister went her entire life without a credit card (I don’t think she has one yet still) and when her and her husband were looking for a house, his terrible credit caused them to be denied! Since she had no credit at all, their combined score was greatly impacted! I have had a credit card open for two years, and I’m always sure it’s completed paid off before the due date. NEVER find yourself in the situation my sister did. Your credit score matters so much for everything.

That had to be so frustrating for your sister! Having no credit {or bad credit} can make many potential opportunities harder to achieve.

I disagree with Dave on this as well. I’m currently in the process of screening tenants for a rental property and am definitely checking their credit reports and scores to determine whether I want to rent to them, just as you say that you do as well.

One additional time that your credit gets checked is when you apply for many professional jobs, most obviously in the financial industry but others as well.

I use my credit cards for everything and pay them off in full, but I can understand how for some people they may present a problem. In those cases I totally agree with your idea of just putting one category of items on their card each month and using autopay to make sure it gets paid in full each month.

I love that a lot of credit card companies give you your FICO score for free these days.

Great tips!

Yes! We’ve turned down tenants with no credit and/or bad credit. Having them show us that they pay their bills on time just doesn’t work for us as landlords {as Dave suggests it would} because we don’t know if there is some financial skeleton out there that they are hiding. If there is one thing we have learned – tenants, and potential tenants, lie.