This Weekly Routine is The Best Form of Financial Self Care

Consistently practice financial self care with this 3-step weekly check-in routine. You’ll move closer to your money goals and regain complete control over your budget!

A few years ago, I found myself in a financial mess.

I wasn’t in loads of debt (for which I’m grateful!), but I’d let weeks go by without checking in on my budget… and it showed.

We always spent more than we had initially planned because we never knew how much money was left in each category. Sometimes, I even missed bill payments (eek!).

I also manually entered our receipts in an Excel spreadsheet, which took a lot of time. I think that’s why I always waited until the end of the month to look at everything.

I needed a more consistent routine. A weekly routine that didn’t take a lot of effort to maintain.

A Friday Finance routine. (Don’t you love illiterations?!)

If you’re feeling overwhelmed with unorganized finances like I was, here’s why I suggest you adopt the very same strategy!

The Importance of a Financial Routine

When you establish a weekly check-in as one of your financial habits, whether it’s daily or weekly, here’s what happens.

You will…

- Always know where you stand financially.

- Maintain momentum toward your savings goals.

- Quickly spot fraudulent transactions so you can take immediate action.

- Spend less time getting everything in order when you do check in, because you check in more often!

Most of all, this Friday routine helped me regain control. I no longer worry if we’re over budget because I check in weekly, and I can pivot quickly (aka reduce my expenses!) if needed.

Curious about what I do during this routine so you can brainstorm how to adopt one yourself?

In this post, I’ll share my favorite tools, the three steps I take during my Friday Finance Routine, and how to practice financial mindfulness every week.

This site is reader-supported. When you purchase through our links, we may earn an affiliate commission.

Tools I Use for Financial Self-Care:

First, I want to give you an overview of all the tools I use so that when I mention them in each section, you’ll already know a little about them.

- Receipt Jar – I use a small jar to hold all our receipts until Friday. This helps keep them out of pockets and purses and floating along the countertops because we know exactly where they belong. I have quite a bit to say about receipt organization!

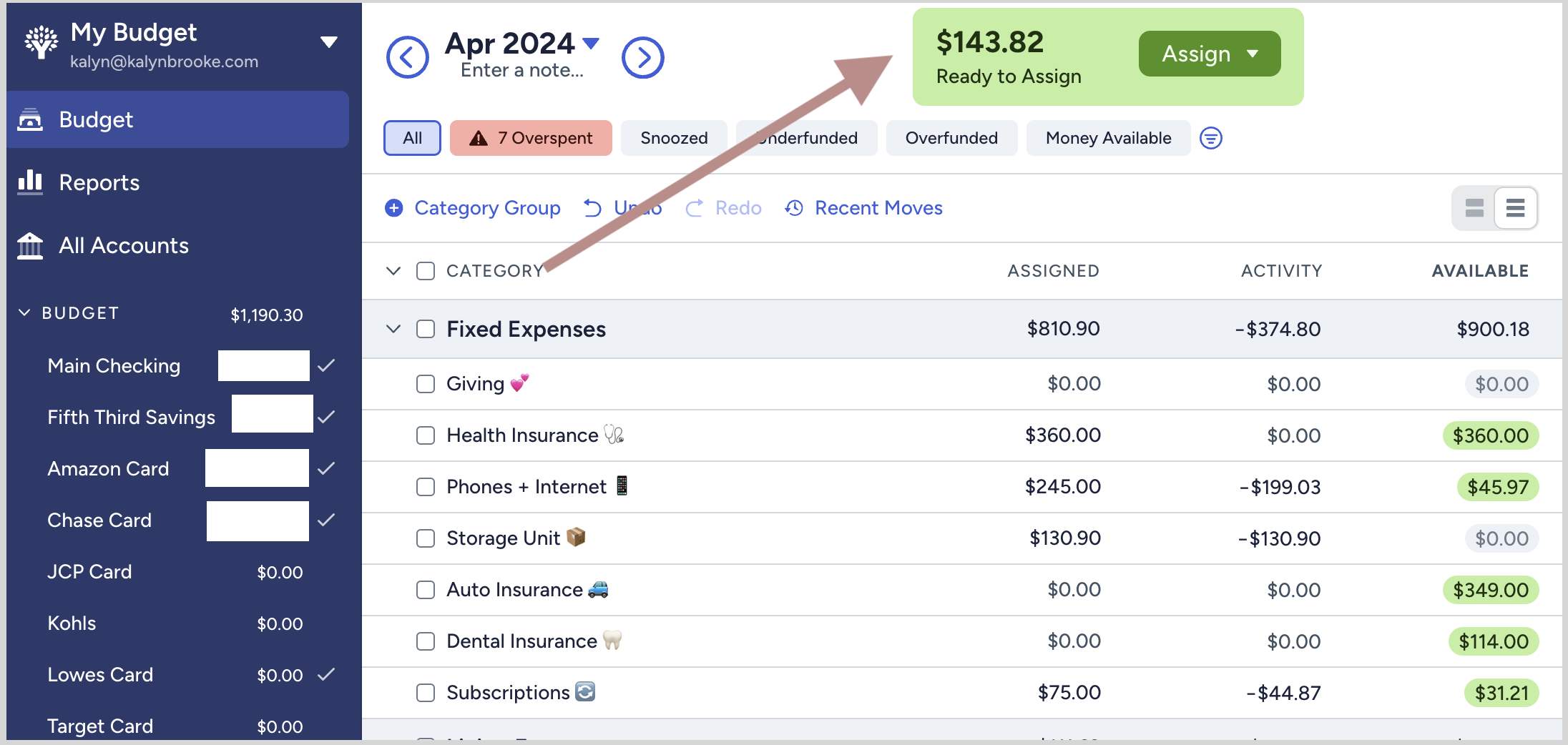

- YNAB App – All my bank and credit card transactions automatically sync with You Need a Budget. It shows me how much money I have left in each category as I spend from that category throughout the month.

- Notion App – It’s no surprise my love of Notion also pops up when discussing financial organization. I created a separate dashboard to show me how much money to allocate to my budget each month, along with savings goals, debt trackers, and a bill pay calendar.

- Receipt File – Any receipts that might be returned (clothing, tools, etc.) are filed by month in a small accordion file. I never want my filing cabinet to look like this again.

After I’m done with business work for the day, I grab/open these four tools, sit down at my desk, and work through each of the following steps. I spend about 15-20 minutes in total!

Step 1: Categorize Transactions

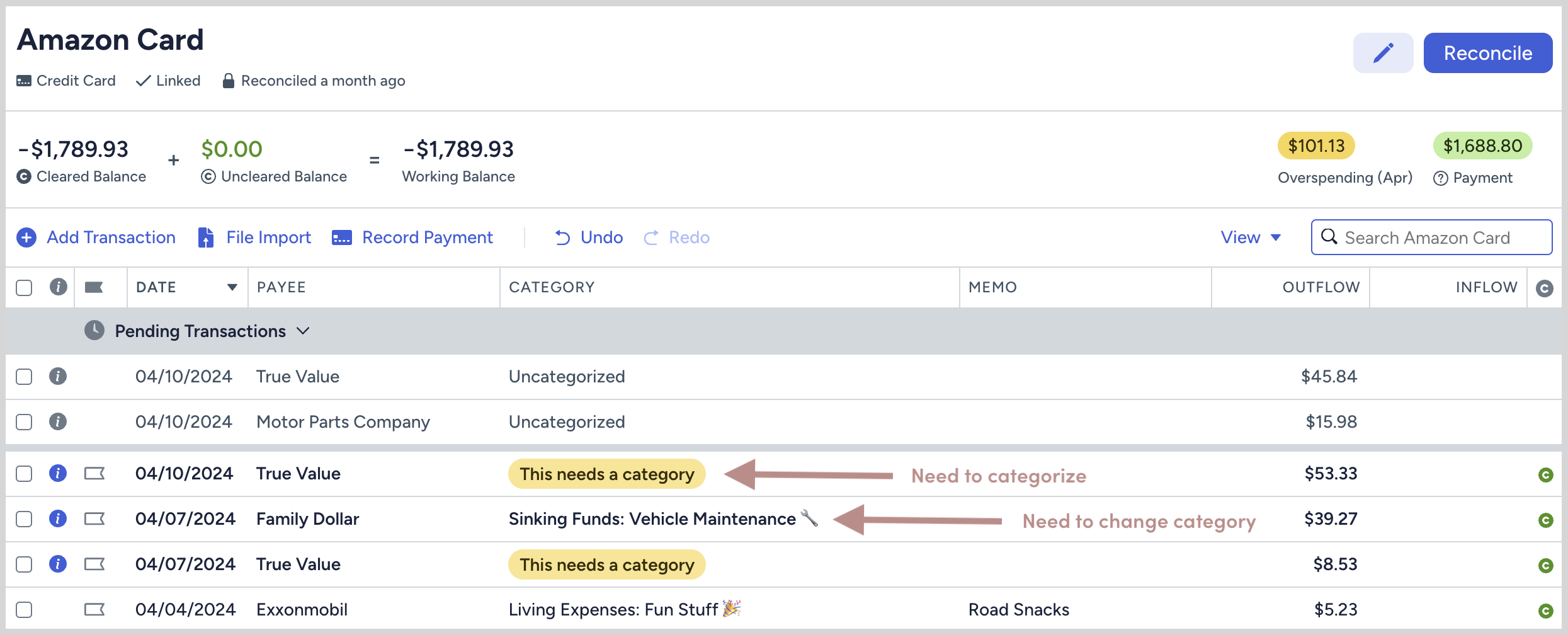

Even though YNAB imports all my transactions automatically, the app doesn’t always know how to categorize them. Or it categorizes them incorrectly.

So the first thing I do is comb through every new transaction to approve or change the category. You can see in the screenshot below that YNAB didn’t know how to categorize the True Value transactions, and it completely misinterpreted the Family Dollar category.

While some users might consider this a downside, it only takes a few clicks to fix. YNAB still streamlines my workflow much faster than if I had to enter each receipt manually, so I stick with it.

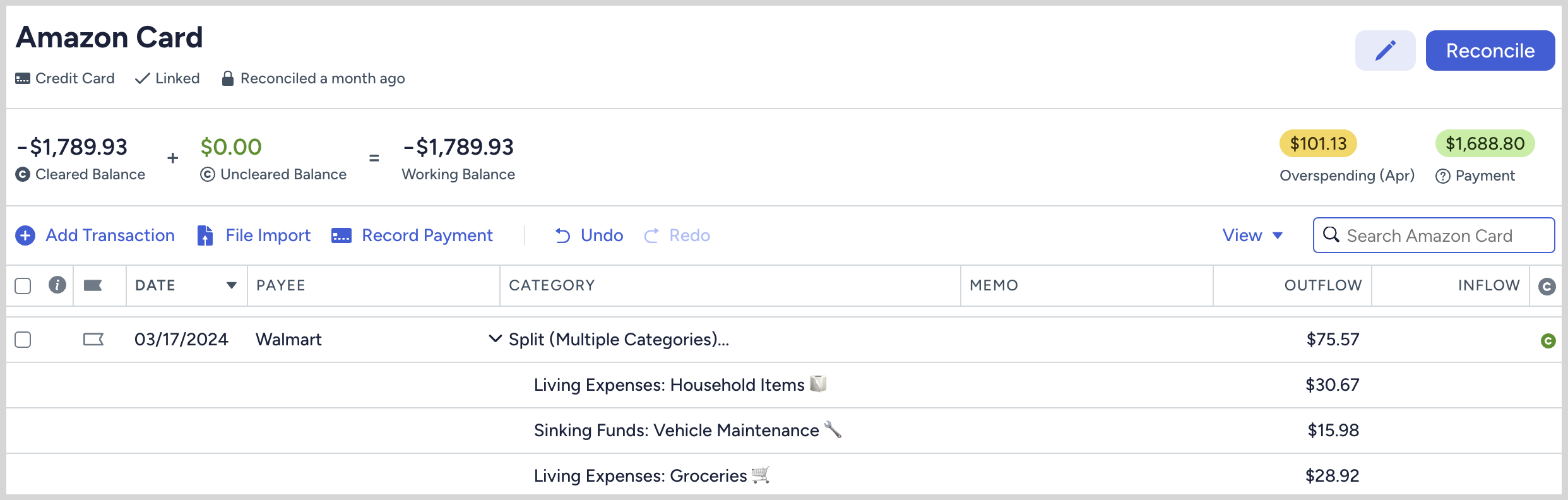

Sometimes, I need to split one receipt into multiple categories.

For example, when I go shopping at Walmart, I typically walk out with items in 3-5 different categories. The transaction below contained Household Items, Vehicle Maintenance, and Groceries.

I never remember how the transactions are split, so this is where I reference the receipts in my receipt jar. I skim through each one and quickly total up items in different categories. Then I either toss the receipt or file it away for later (mostly because I might be returning an item on that receipt or I need it for a warranty.)

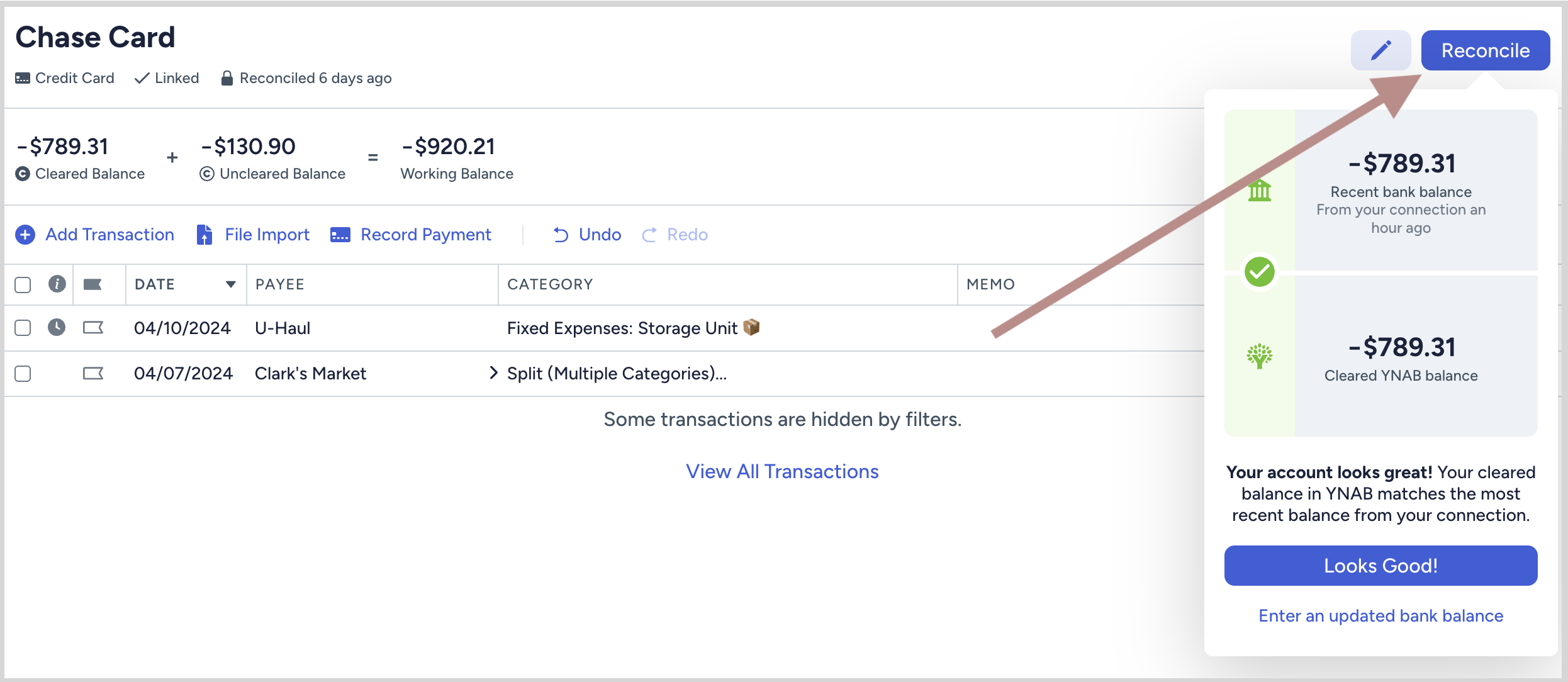

When I’m done categorizing everything, I double-check each account, matching what YNAB says my current balance is with what the bank/credit card says to ensure there are no missing transactions.

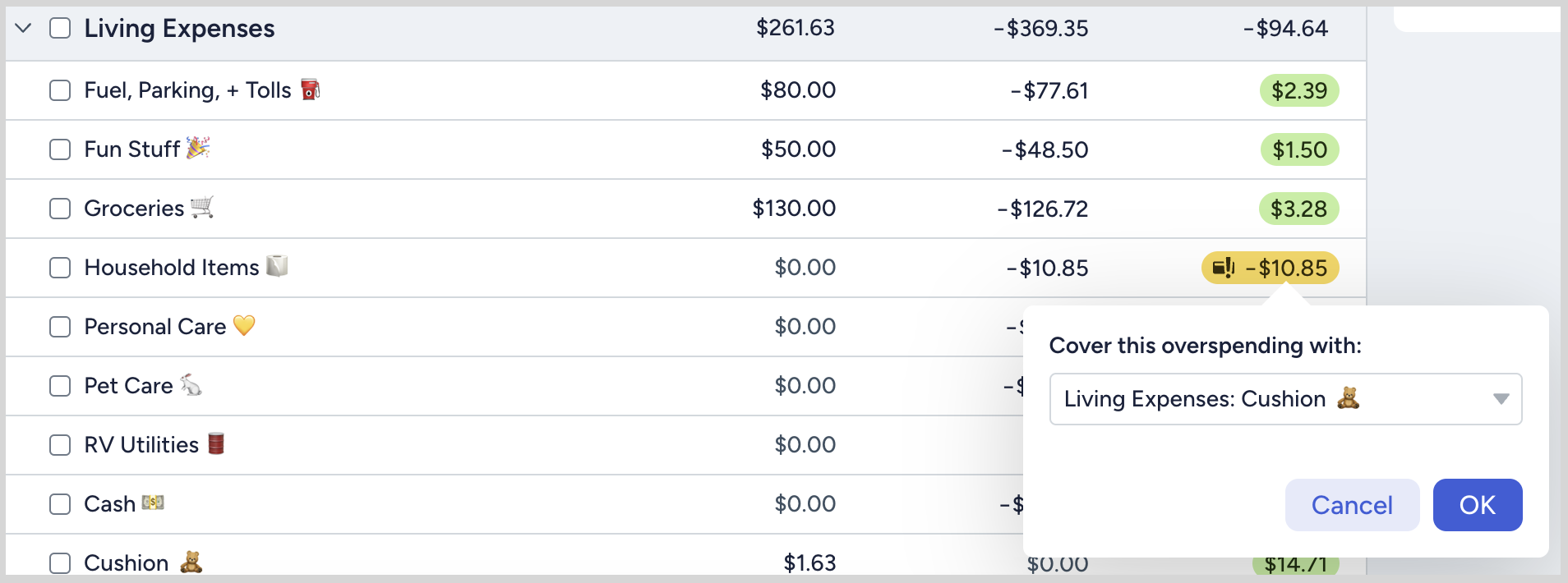

If I’ve gone over budget in any of my categories, I see if I can cover that overage with another category that might have extra money in it, or I assign new income to that category in the next step.

If you want to learn more about this incredible app, here’s a more in-depth look at how YNAB works!

Step 2: Assign Income

Next, I assign any new income that has come into my accounts. YNAB automatically adds this money to a “Ready to Assign” category.

FYI: YNAB differs from other budgeting apps in that you only assign money you have in your accounts to your budget categories.

Other apps (like EveryDollar) prompt you to assign a budget amount first, based on what you think you’ll earn that month, whether that money is in your account or not. This is called forecasting. This method takes some getting used to, but I like YNAB’s approach better!

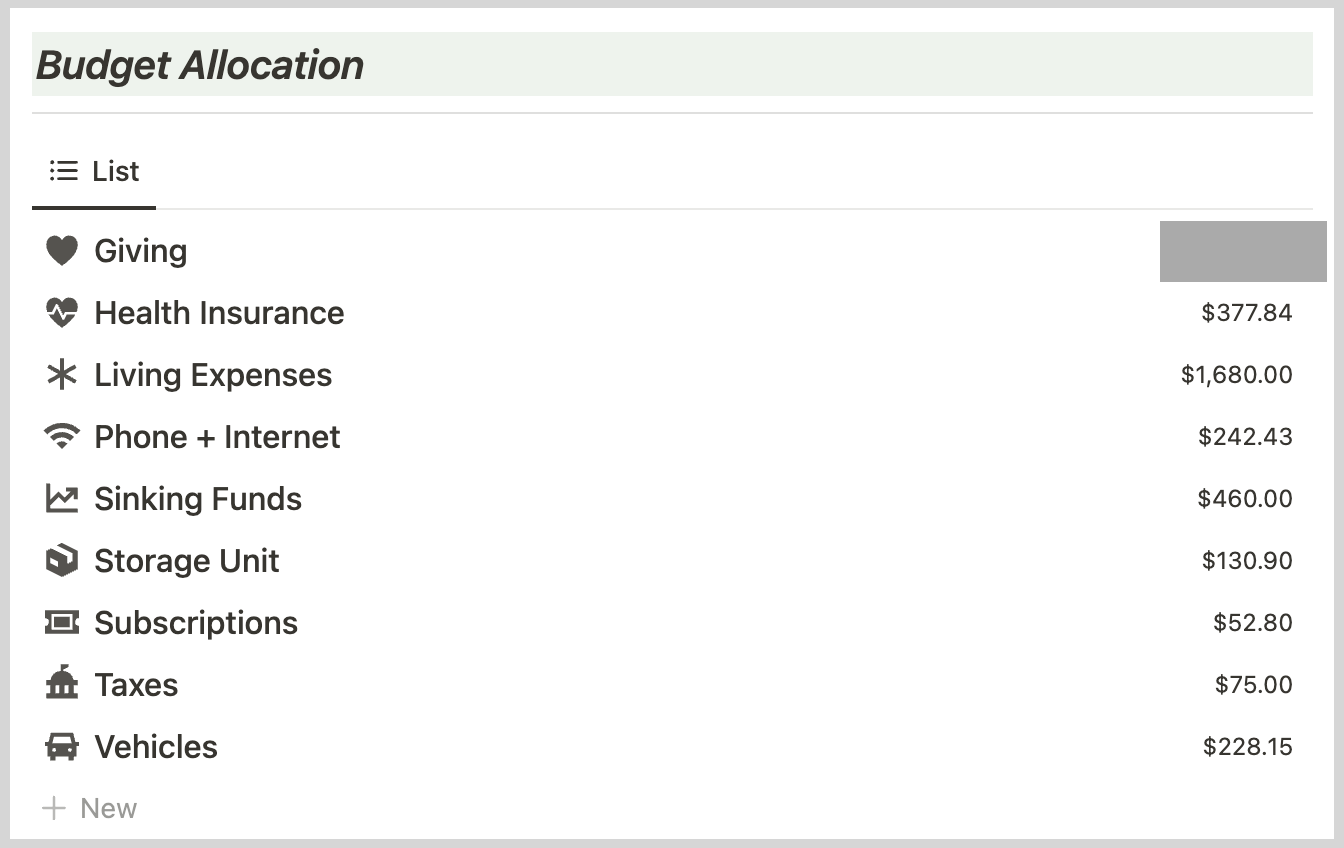

However, I still need to know my typical budget amounts for each category so that when I DO assign the money that comes in, I know exactly how much to put where.

That’s where Notion comes in.

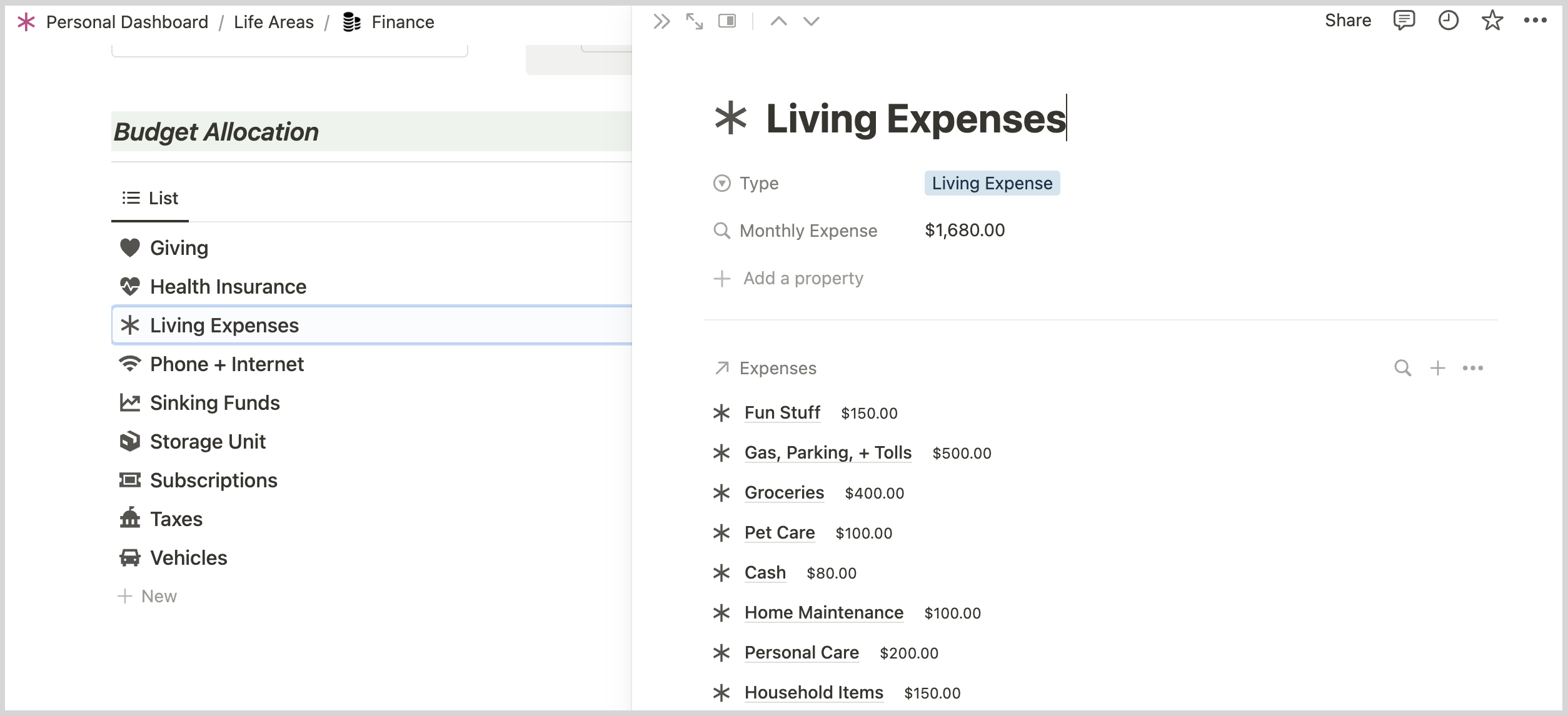

I reference my Budget Allocation section in Notion, which displays my main budget categories and how much I want to budget for each per month.

These categories are clickable, so I can see a further breakdown if needed, like in my Living Expenses category.

Quick SIDENOTE

If you’re curious how I did this, I created two Notion databases. One is called “Bills + Expenses,” and the other is called “Categories.” Then, I related them to one another using a Relation Property, calculated the monthly amount that I needed to budget for each expense, and rolled up that amount for each budget category.

The monthly amounts for Fixed Expenses (like the storage unit, health insurance, vehicle insurance, etc.) stay the same each month.

Living Expenses (which are more fluid), are a little bit different. I determined a monthly amount based on what we need for that category/what we typically spend. But I can also adjust that if needed. For example, if we are traveling in the RV for further distances, then I would probably put $600-$700 in our Fuel category instead of our typical $500 budget.

All that to say, this section inside Notion is essential for me to reference when assigning new income in YNAB!

Step 3: Pay Upcoming Bills

Lastly, I pay any bills due within the next two weeks. I like to plan ahead in case something comes up, and I don’t get to my Friday finance routine until Saturday.

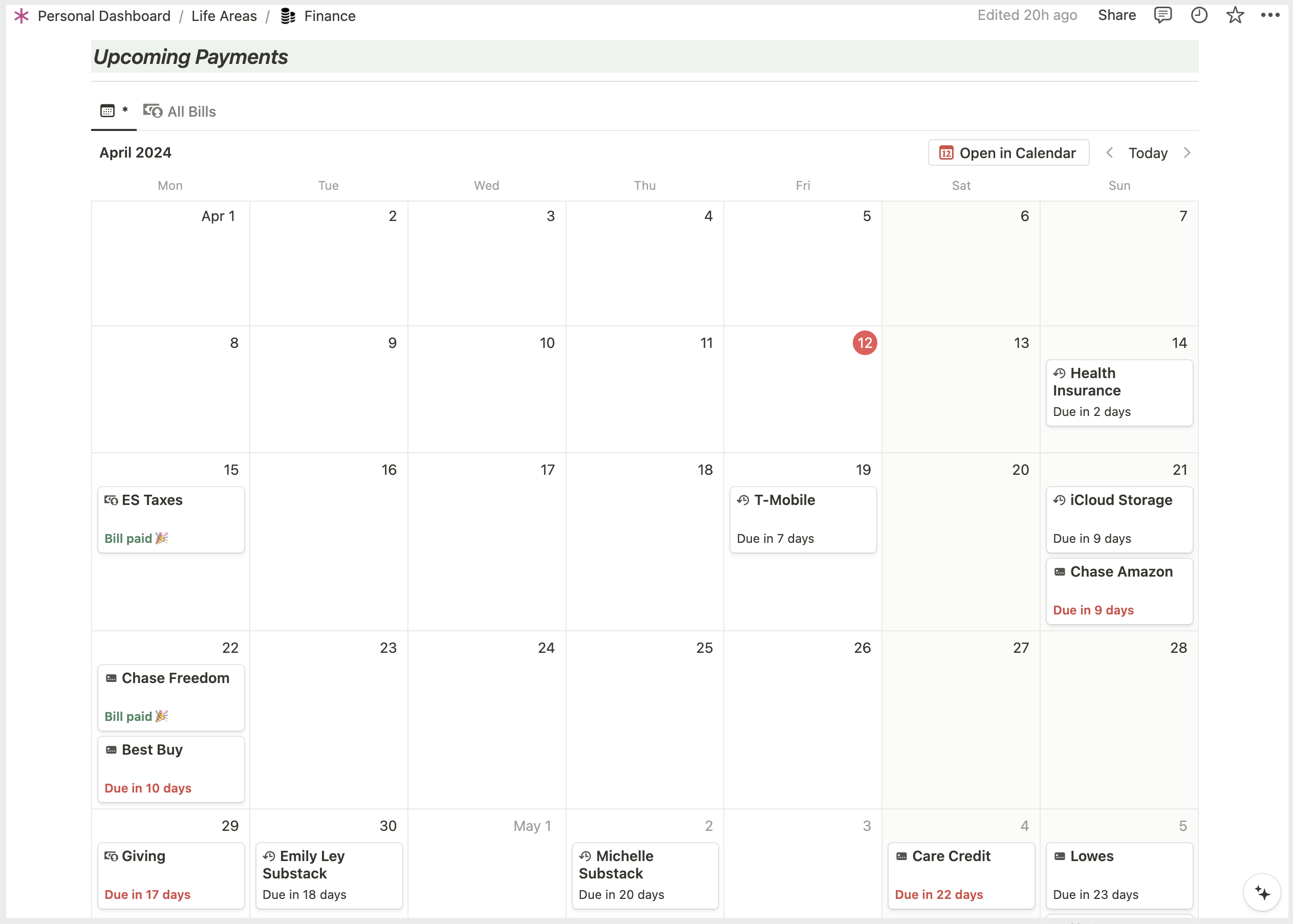

In Notion, I created a Calendar View of my Bills + Expenses database so I can easily see when each bill is due.

All bills that display a red “Due in X days” text are bills that I need to log into each website and pay. Otherwise, they are automatic payments that I don’t have to worry about! I just like knowing when they come due.

After I record the payment in Notion, the text turns to “Bill paid 🎉”. These bills recur every month based on a “Next Payment” formula, which I share how to do in this Build-Your-Own Subscription Tracker tutorial on YouTube.

And that’s it!

I practice this fairly simple 3-step finance routine every Friday afternoon and no longer worry about my finances. Everything is neatly organized and accessible. And because this system is so easy to maintain, I’m more likely to follow through.

The Best Way to Prioritize Your Finances

If you want to prioritize anything important to you (in this case, your finances!), you must establish a workflow, system, or routine for it.

Otherwise, our best intentions will remain as such, rather than actually doing the thing we want to do!

- If you want to write 500 words a day, create a writing routine and track your progress in Notion.

- If you want to read every day, create a reading routine. I read during lunch and before bed!

- If you want to stay on top of your finances, which will allow you to save and spend more intentionally, create a finance routine. Hint: it doesn’t have to be on Friday!

A routine integrates any activity into a normal part of your everyday schedule. And when you stick to that routine, you will reaffirm that this practice is important enough not to skip.

I hope this post was helpful and gave you some ideas on how to organize your finances!

more posts about

Habits + Routines

Do You Have a Finance Routine?

Don’t be shy about sharing your takeaways (or things you do differently) in the comment section. I’m always fascinated by how others track their finances and what methods/apps they use!

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

Where do you get your binder your talking about in this post? I have looked at several but cannot find anything larger than 5×8

I purchased mine at Staples. I don’t think they offer that design anymore though!

Excellent post! Thank you for sharing the visuals as well. I tried YNAB and I think not realizing that I could also have a physical worksheet to fill in the gaps is what was missing. Thank you for that!

You are very welcome!! I hope it works well for you.