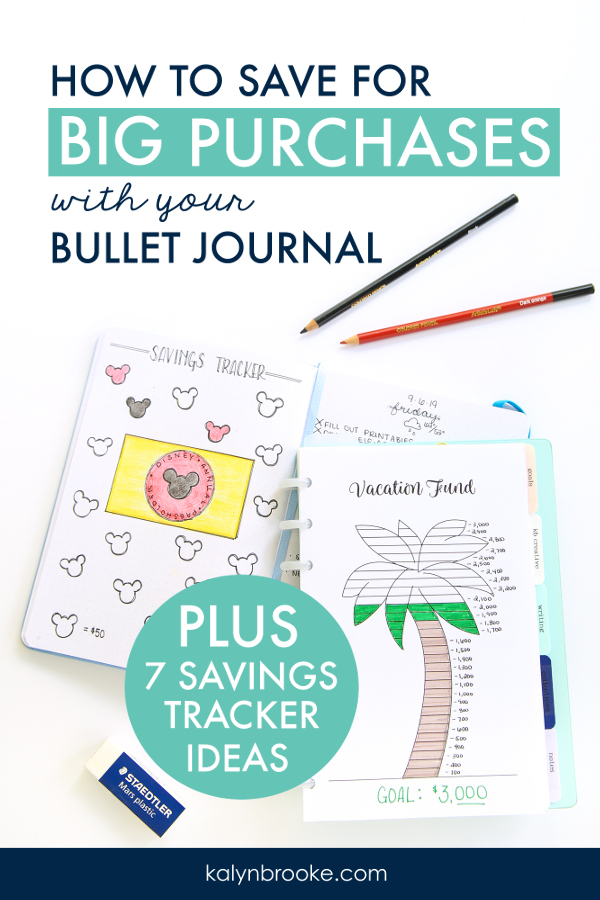

How to Save for Big Purchases with Your Bullet Journal

It’s so hard to stay motivated when saving up for a dream purchase, am I right?

With everyday expenses soaking up the majority of our paycheck, it’s easy to have nothing left to put towards that cruise we’ve always wanted to take, new granite countertops for our kitchen, or even a new car for when our current one is too costly to repair anymore.

Which is why tracking (and seeing!) your progress on a regular basis is essential to making those dream purchases a reality!

And what better place to do this than in your bullet journal with a savings tracker printable?

Personally, I love that right in the middle of my monthly, weekly, and everyday planning, I can flip back to my savings tracker pages and be reminded every day that I’m getting closer and closer to nabbing a Disney annual pass for Joseph and myself.

Plus, it’s so much fun to color in each section and see consistent progress as we make each deposit!

HEAD’S UP: If you’re more of a digital gal, you can easily track your savings in a high-interest online account with the Dobot savings app. I actually do both. I love the physical part of tracking money (it feels like I’m actually saving something tangible!) but also love that my money earns a higher interest rate and is less tempting to touch.

Ready for some fun ideas that will inspire you to stash money away toward a future purchase?

1. Use a savings jar … sketch

By far, the most popular bullet journal savings tracker printable is a savings jar. That’s because this design is highly versatile. You can literally save up for anything!

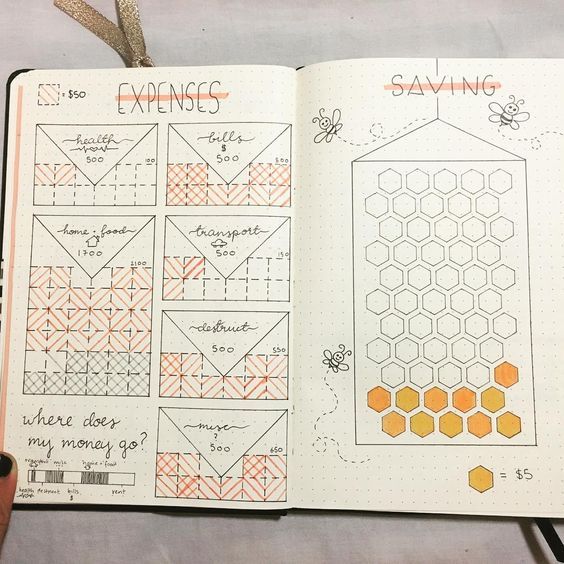

2. Get Creative with Geometric Shapes

Draw out simple shapes with an inexpensive stencil set and let each shape represent a specific amount of money. I absolutely adore this honeycomb design and even used it as inspiration for one of our Brainbook Library Mood Trackers!

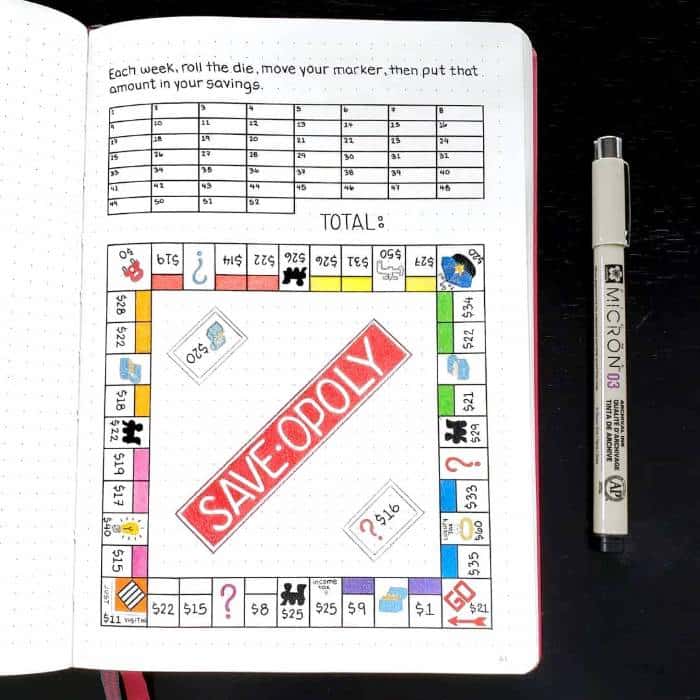

3. Play Sav-opoly

If you want to stretch your creative muscles, you’ll enjoy creating this new take on a popular board game. Roll the dice, move that number of squares, and put that amount right into your savings account.

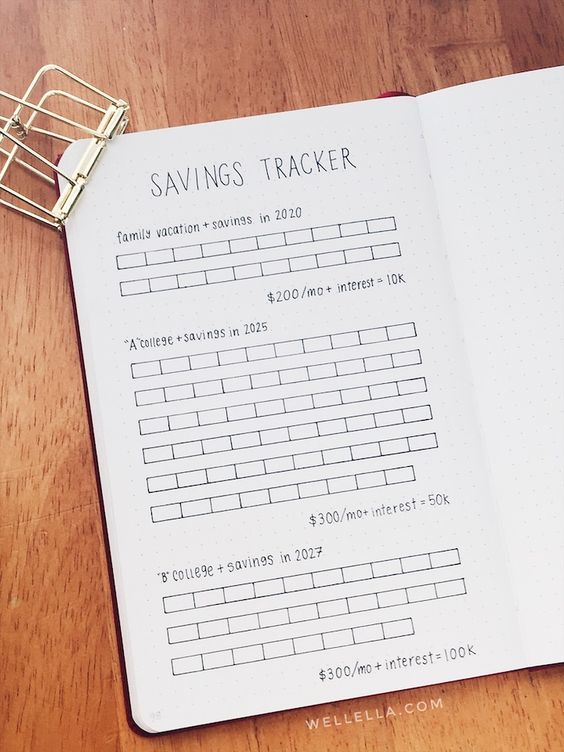

4. Keep It Simple

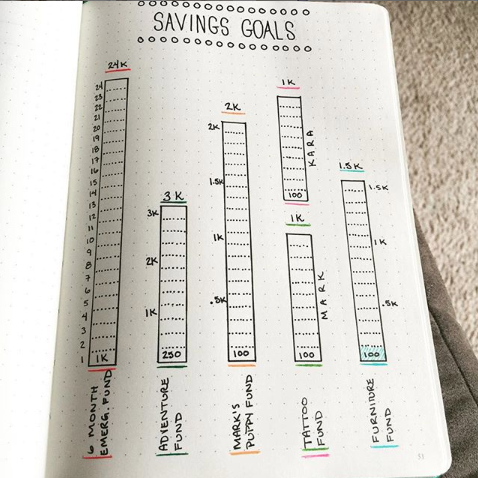

If you want to keep things super simple, this minimalist savings tracker gets the job done in the most efficient way possible. Plus, you can see your progress for multiple savings goals on one page. (Because really when are you not saving up for multiple big-ticket items at once?)

5. Go Vertical

Another layout that allows you to save for multiple goals at once are vertical savings stacks. Assign a different purpose and amount to each one and color in each bar as you make a deposit.

6. Play Tetris

As someone who loves puzzles (I recently discovered crystal puzzles from my niece and fell in love!), I’m a huge fan of this Tetris-inspired savings layout. Assign each piece the same value or use a different amount for each type of shape.

Related: How to Build Your Emergency Fund Fast!

7. Make it Visual

Lastly, and one of my favorite ways to save toward a dream purchase is to choose an image that represents what you’re saving for. Then draw or print an outline of that image and split the design into multiple horizontal lines. Instant savings tracker!

If you’re totally on board with tracking your savings in your bullet journal but you’re nervous about unleashing your creative talent onto the page, don’t worry! You don’t have to draw a savings tracker on your own. (The photo shown above is actually a pre-designed savings tracker printable!)

When you sign up for a digital membership to the Brainbook Printable Library, you’ll get instant access to printable savings trackers AND loads of other handy layouts, including:

- Monthly calendars

- Weekly planning spreads

- Daily to-do pages

- Habit trackers

- Mood trackers

- and more!

These printables allow you to customize your own unique bullet journaling system in less time. Plus, you’ll never run out of layouts to try with new downloads released every Tuesday.

LEARN MORE ABOUT THE LIBRARY HERE.

Consistency is Key

However you choose to save, do it in a way that makes your goal feel more real to you and motivates you to reach the finish line.

Work your savings goal into your budget and save for it like you would any other expense on a weekly, bi-weekly, or monthly basis. Then open up whatever savings tracker printable you use to color in that next spot and celebrate being one step closer to your dream purchase.

As a data-driven gal myself, tracking is one of my favorite parts of saving money. Well, that and finally reaching a well-deserved savings goal, of course!

What dream purchase are you saving for right now?

Disclosure: Some of the links in the post above are affiliate links. This means if you click on the link and purchase the item, I will receive an affiliate commission. Regardless, I only recommend products or services I use personally and believe will add value to my readers. Read my full disclosure policy here.

Great ideas! I love that you are saving for annual passes. My husband and I go to WDW once a year.

We hope to get the value out of them to the point where we are “Disney-ed out.”

Who am I kidding? I don’t think I could ever be Disney-ed out. 🤣