Create Your Own Money Management System

Let me teach you How to Manage Money Better with this simple Money Management System. This is the fifth post in the Creative Savings’ Beginners Guide to Budgeting Series. To read all posts in order, start with Why You Need a Budget, then continue reading the rest of the series on this page.

Now that you’ve created your very own budget, it’s time to focus on putting that budget into practice with a money management system {MMS}. If that sounds technical and complicated, it’s really not!

This is just a detailed overview of your entire finances so you know exactly what you’ve already spent, and what you have left to spend. Otherwise, it would be way too easy to go over budget, and we wouldn’t have any practical or solid way to keep ourselves accountable.

So, let’s talk more about exactly what a MMS does, and how to set one up!

Real Time Tracking

Dave Ramsey would say that the best way to track budget amounts is with the cash envelope system, and if you struggle with the temptation to overspend on your credit card, I would have to agree. However, it just didn’t work for us. My husband actually spends more with cash in his pocket, and I did not feel safe carrying all those bills around!

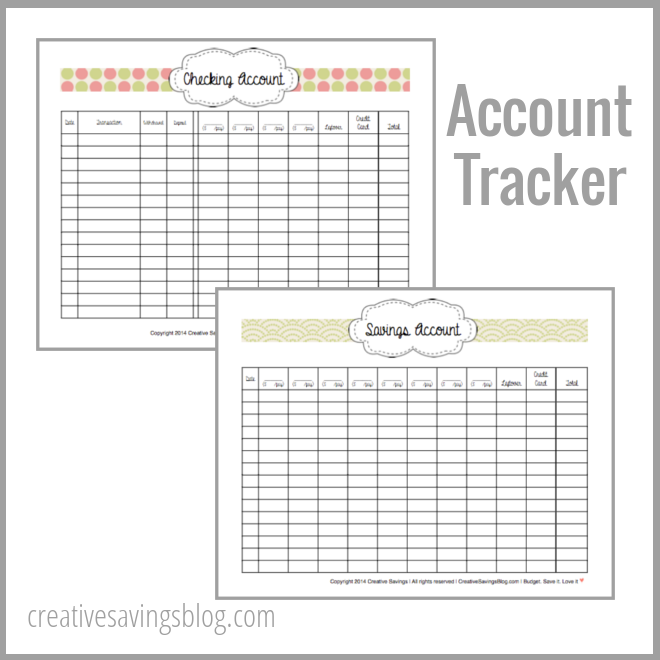

Instead, I use a money management system that is more of a modern day twist on that concept. Rather than pull your monthly totals from the budget sheet in cash, you assign them a column in an account tracker, which is basically a glorified checking and savings account register.

This tool hosts all your budget categories and amounts, and the final total always equals the exact numbers in your checking and savings. It also tracks all your expenses in real time, so you know what you have to spend at any given moment!

So grab your budget sheet, then print out a copy of the account trackers below. This is probably the most comprehensive step of them all, so I encourage you to read very carefully — we’re about to cover a lot of details — but it will be SO worth it!

Download the printable checking file | Download the printable savings file

How to Set Up an Account Tracker

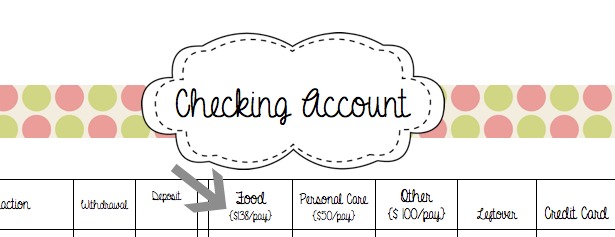

1. “Carry over” all of your budget categories from the budget sheet into your checking and savings account trackers, and write them across the top row. When deciding which categories to use and where, there are two things you need to remember:

- The checking account should hold categories that are a lot easier to access than the savings. {i.e. purchases you see yourself making every week or two weeks.}

- You can use broad categories, or their respective sub-categories based on how detailed you want your tracking to be.

I like to use broad categories because it gives me flexibility to spend what I need within the entire column. For example, I could overspend in Eating Out, but underspend in Groceries, and as long as I come in under the Food budget, I’m still OK.

However, be careful when working with categories that contain both fixed and variable expenses. Variables can easily cut into your fixed {i.e. home improvement vs a mortgage payment}, so it’s best to keep those separate as much as possible.

2. Determine when you will “deposit” money into each of these columns. Your budget was originally created based on monthly amounts, but now you can break it down even further than that, depending on how often you get paid.

If you get paid every two weeks, divide your monthly budget categories by 2. If you get paid every week, divide it by 4. Write these numbers underneath your budget categories for each column. Then, every time you receive income from a paycheck, carry these amounts into each of your columns and add it to the final total.

If you receive income that changes significantly month-to-month, or you don’t get paid for weeks at a time, try to mimic a steady paycheck as much as possible by pulling out the same amount each month to distribute among your columns.

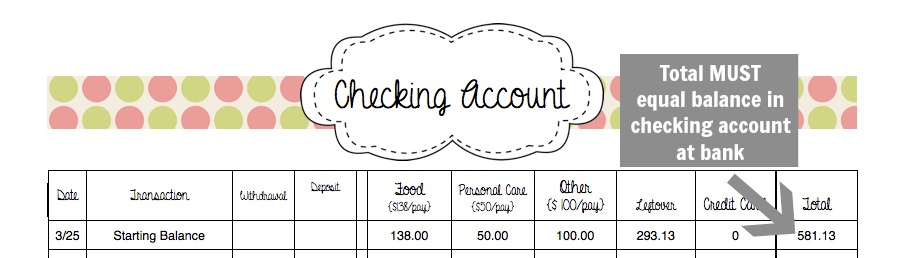

3. Write in a starting balance for each column based on the budget amounts from your most recent paycheck. You can really use any numbers you’d like, but I would suggest you start with previously budgeted amounts to make it easy.

Remember, your final total needs to equal your Checking or Savings account exactly, so don’t worry if you have a lot of money in the Leftover column – we’ll talk about a lot of fun {and responsible} things to do with that category in the next post!

Now that your personal MMS is prepped and ready to go, we can start using it right away.

How to Use an Account Tracker

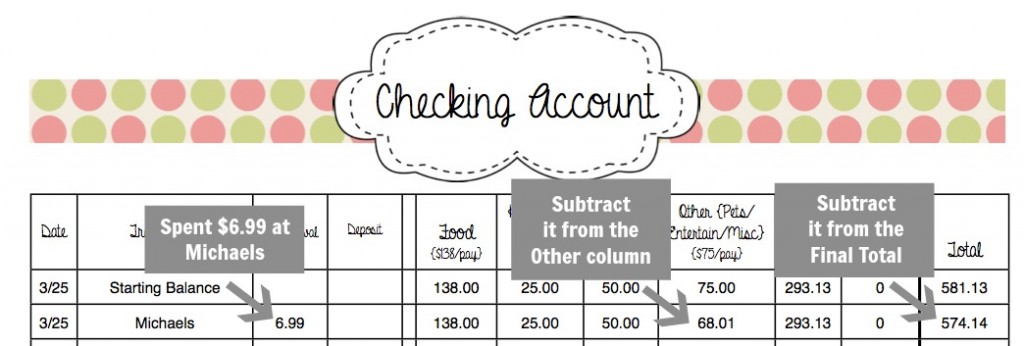

Any time you make a purchase at the store, withdraw money, or make a deposit into your checking or savings accounts, immediately subtract from {or add to} the specific columns of your account trackers.

This keeps a running tally so you know what money is available in each column to spend, which in turn, keeps you from going over budget. You may find it helpful to stash your Checking Account Tracker in your purse, so you know at any time how much you can spend on food, toiletries, clothing, etc when shopping at the store.

Totally committing to this real time tracking system will help you avoid unnecessary purchases with your debit card, but I think one of the coolest features of this system, is the ability to use credit cards too.

Using Credit Cards in Real Time

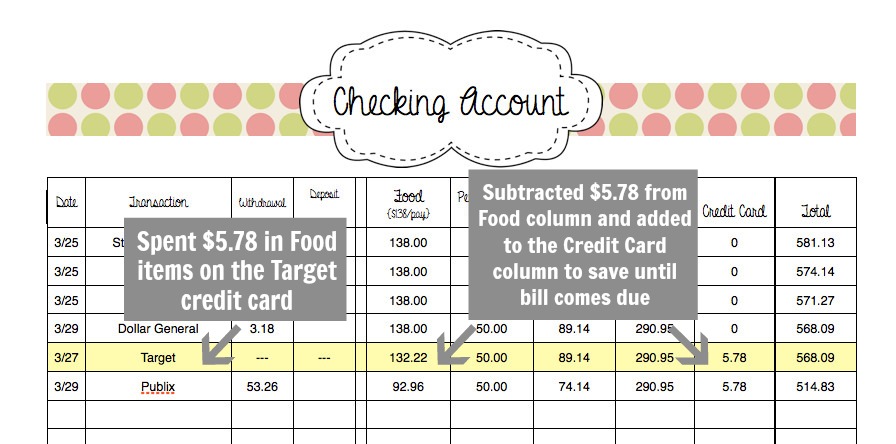

Credit cards are great to use every now and then for rewards and cash back, especially when you’re at a restaurant or need to order something online. I have purposefully included a Credit Card column on each of the Account Trackers to help use credit cards just like cash.

Whenever you charge anything to a credit card, that amount should be taken out immediately from one or more of the category columns, and transferred to the credit card column where the money will be “held” until it’s time to pay your bill. When the credit card comes due, you will always have enough in that column to cover it…in full…every month.

Even though this might seem like a foolproof method to using credit cards, I do caution you to avoid doing this if you currently have credit card debt. Instead, focus on paying off your balance first.

Whew! That was quite a bit to take in for one post, but now you’ve come full circle and know exactly how the entire budgeting system actually works.

Don’t be discouraged if it takes some time to set everything up. Once you get into a weekly, and monthly habit of tracking everything, it will become second nature. I promise!

Related: How to Organize Your Finances

In the next step, we’re going to talk about how this system will help you reach all of your savings goals. Whether it’s paying down debt, saving for vacation, buying a new car to replace your rusty junker, or finally tackling that home renovation, the possibilities are endless because now you have exactly what it takes to succeed!

What system helps you stay under budget?

{Go to the next step: I Have a Budget….Now What?}

Getting your finances in order can be really overwhelming!

If you need more hands-on help, my friend Jessi is a financial rockstar and shows you step-by-step how to set financial goals, stick to a budget, and develop a concrete plan to attack that debt monster.

It’s all found in her course, the Real Life Money Plan, where you’ll get a printable workbook, in-depth videos and comprehensive worksheets to map out your entire financial future. I promise you will love her as much as I do! Learn more HERE.

I liked how you mentioned that a money account tracker can help you manage your money. My brother is wanting to manage his money for his business. I’ll tell him that he should utilize a money account tracker.

Thanks so much for sharing!

Thank you, Kalyn, very much for such a detailed strategy. I always had problems with my credit cards, forgot to pay, and didn’t leave any money. As a result,I had to pay with high rate. I will use your method, write everything in tables.

I hope it works well for you!

I liked how you mentioned that you should use your account tracker every time a purchase is made. My wife and I are wanting to manage our money better and we were wondering how we could track our spending. I’ll be sure to tell her that we should use an account tracker to track our expenses.

It’s really helpful! I hope it works for the two of you.

This link for the Budgeting Made Easy sheet isn’t working for me. Is it me or the link?

Hi Lisa,

I’m so sorry for the delay!! I just checked and the link does work, however it is a pop-up box so if you have pop-ups disabled that may be why it’s not showing up for you. If you still would like the sheet you can email [email protected] – ask for the Budgeting Made Easy sheet and we’ll send it right over!

Hello! First off I would like to say that I love your budget system!!

Although I am confused on how to use the checking and savings tracker. What budget categories do I put on the checkings. (I want to put Home, Food, P/C, Utilities, Car, Medical, Other, Loans/CC in the Checking account tracker) Would that be correct or no? Much appreciate a reply!!

🙂

Hi Lucy! I’m so sorry it’s taken me a while to reply. If your still struggling with the categories here is my best answer… it’s up to you. 🙂

I used to put our “fluid” categories (no set due date) like Gas, Food, Clothing, etc. in our checking account. Then I would put our “stable” categories (set due dates) like our mortgage, utilities, insurance etc. in savings.

When the due dates approached for our “stable” categories I would either pay directly from savings (if I could) or transfer the money over to our checking account and then pay it.

We did this primarily because we wanted to get the better interest rate from our savings account and keep as much money in there as possible. Since then – our interest rates have changed… drastically, to the point where we wouldn’t make any extra money in interest anymore by using the savings account. So we’ve changed.

Now, I keep the majority of our categories right in checking. This reduces the number of times I have to transfer money. The only categories we have in savings are: Emergency Fund, Travel, and Debt Payoff.

So which categories you put where is completely your choice. Some people don’t like to keep a huge balance in their checking account which how this system was set up, but you can add as many columns and categories as you want in the spreadsheet that’s provided.

Does that help answer your question? If not please don’t hesitate to reach out again.

Thank you so much for this! I’ve made budgets in the past but have been horrible at sticking to them, so that is my goal for October… I have a question about the Checking and Savings Trackers. How long should you update the same document for? The rows fill up basically as fast as the rows on the Expense Tracker, but there are no month tabs on the Checking/Savings Tracker. Should I be making a new document for every month? Thanks!

I start a new sheet for every month, but always end up with multiple sheets for one month. Hope that helps!

Hello! So I love this system! I am really new to all this budget stuff. I have a question, so the checking account sheet is kinda like the expense tracker? Minus the bills? Bills go on the saving account sheet? Just a little confused. Thank you Feel free to email me.

Even thought the checking account sheet and expense tracker are similar, they are different in this way:

1. The checking account tracker keeps a running tally of all the money that is in your checking account, and shows you exactly where that money is divided among the expense columns.

2. The expense tracker just keeps track of expenses so you know how much you spend in one particular category every month.

And yes, I pay most all my bills from the savings, while checking is more for discretionary purposes.

I hope that makes sense! FYI: I’ve been working on a new system that combines the checking account tracker and the expense tracker so you only have one sheet to work from instead of two. I’m very excited about it, so stay tuned! 🙂

I never leave a comment, but had to leave one in response to these posts. Its exactly what I needed to get on on track with our finances. Thank you so much for sharing it!

I am so excited to hear that, Asja! Good luck!

I’m just so confused by all of this… Where do you put your bills in on these account trackers? Only 4 catergories is very limiting for an entire household’s spending. I don’t want to put my mortgage payment budget amount in the same column as say my budget for paper towel at Target… Are these trackers just for variable expenses?

Please help 🙁

Dee, the Checking Account Tracker only has 4 categories because it is more for variable expenses, while the Savings Account Tracker has more columns and space for all those bills. I have it this way, because that is how we have personally set up our Checking and Savings accounts, and the trackers correlate with both. If you need to customize it more to fit your needs, the excel file is a great tool to download and add as many categories as you want. I hope this helps and please let me know if you have any more questions!

I am having a hard time figuring out what to do on the checking account and savings account trackers. Could you please email me and I can give you more specifics on the money I am dealing with. Thanks!

Just sent you an email, Kelly — we will get this figured out! 🙂

I really want to try switching from cash to using our debit card (it is so hard to rifle through three different envelopes at the store!), but I’m having a hard time figuring out how to make this system work with a more specific budget. To fill in all my categories requires four sheets of paper, which just seems like a lot of paper to replace for every fifteen transactions. Do you have any suggestions to make this work more easily with a lot of categories? Or a different paper system that would be good? I’m really banging my head against the wall on this one, so any help is appreciated!

Joni, thanks so much for taking the time to comment! I totally understand your frustration as it’s one I have had with any paper system I’ve tried too. They are just so limiting, which is why I really take time before I start to see which categories I can combine together. If you want to keep everything really specific, I would try the Excel system or an app. I know there are a ton of budgeting apps out there that make tracking for multiple categories really easy. I have heard good things about https://www.clearcheckbook.com/, although I have not personally tried it. Hoping to do a post on comparing apps soon!

I know that’s probably not the answer you wanted to hear, but keeping your categories fairly broad is really the best approach to any paper system. I hope that helps a little bit!

Thanks for replying! I tried several different free budgeting apps, but they were never customizable enough for what I wanted (or maybe I just couldn’t figure out how to use them properly!). I actually ended up watching some intro to Excel tutorials on YouTube (gotta love YouTube!) which gave me enough skills to make my own workbook based on yours that is working really well for me so far. I formatted mine so I could enter individual transactions (like -$35 under the grocery category) and it automatically keeps all my totals for each category at the bottom of the page so I don’t have to do any math in my head or dig out a calculator. It also totals each transaction to the right (so I can make sure it matches my starting deposit or withdrawal amount and I distributed it across the categories properly) and then the bottom right corner totals to show the total amount in my checking account. Now that I know how to do some basic things on Excel, I am in love with it! I also made my own version of your Income and Expense Trackers. So thank you for inspiring me to enter the world of Excel =).

You’re welcome! It’s hard to find something that meets your needs exactly – everyone’s finances are so different! I’m so excited you were able to figure out Excel and make it work for you!!

I am so excited and relieved to find this! I have been beating myself up for several years about the fact that the cash envelope system has never worked for me! This is what I needed. Thank you! I can’t wait to try it. It’s really quite simple yet so genius! Thanks for sharing thus with others. Very generous of you. 🙂

I know exactly what you mean! I hate using cash and really needed to find something that worked without it. I really hope this system helps you succeed!

I love how you do not use actual cash. Every Friday(payday) I used to go to the bank and pull out my budget for the week in cash. Then 2 weeks ago I headed to a city away from where I live ( about hr and 15 mins away) and I just didnt make it to the bank. I ended up loosing my wallet at Winn dixie. Im so thankful I didnt have any cash, because all I had to do was cancel my debit cards, so we werent out anything.

Even though it’s never personally happened to me, it’s stories like yours that make it one of my major fears. Thanks for sharing!

Hi Kalyn,

I’ve been on your system since step one and I am really happy to finally start with the MMS as of May. Thank you so much for your work with setting this up. It’s been a really great help and it’s the very first time that I actually have an idea where my money goes… The only two things I haven’t understoodand hopefully you can help with this: 1. what exactly is the difference between the sheet for Checking and Saving and why do these two sheets look differently? 2. What goes into the Leftover column, mine is 0 😀

Thanks again for your brilliant tips!

The Checking and Savings sheets are different because they are tied to your two separate accounts. So your Checking Tracker will be your check register for your checking account, and the Savings tracker will correspond to your Savings account. I don’t have detailed transaction lines on the Savings account, because I don’t transfer money in and out of it as often. It’s more to let the different columns grow before I transfer them over to my Checking to pay my bills – usually once or twice a month – but I like to keep track of all my columns just the same.

Also, the Leftover column is just to catch what isn’t budgeted for. Since it’s zero, you don’t have any money left over because you allocated every dollar. That is totally fine! I usually only have $20-30 in there as a buffer in case I go over one of my other columns. Then I can use the Leftover column to supplement.

I hope those answers make sense and I’m so glad you are enjoying the series! Let me know if I can be of any additional help, or clarify anything I’ve said here. You can also feel free to email [email protected] and I can talk with you further. 🙂

Aaaaaah, I think I got it now. So in case I had a bill to be paid once a year, for example, I would budget a monthly amount (since I’m receiving my income on a monthly basis) and document this on my checkings account sheet, transfer the money to my savings (on a monthly basis) and document it on the savings account sheet. Once the bill comes due the whole amount is transfered back to checkings and paid? Does that makes sense?

Another question: do you have any good tips (or article suggestions) since my boyfriend and I split our variable costs only once by the end of the month. We are keeping all the receipts and have one day per month where we balance them. Makes everything a little bit more complicated to budget…

THANKS SO MUCH for your help with all of this! Fun thing is I used to hate figures, data analysis and all that but with this system I really start enjoying it 😉

Yes, exactly! As for your other question, here are a couple ideas:

1. You could use a cash envelope system for your variable expenses. Decide on how much you want to budget for each, then divide it by 2. At the beginning of the month, both of you should pull out that amount in cash from your separate bank accounts, and put it in the envelope. You can now use it to go shopping or out to eat without worrying about how the bills are split because it comes from that one source. If you happen to be out and forget the envelope, you can always use it as a “petty cash” system and reimburse whoever bought the supplies or dinner out from the cash envelope.

2. If you don’t want to use cash, decide on a budgeted amount for one category and create a column for it in your Checking Account Tracker – let’s use Groceries as an example. Say you budget $200 for the month, so you each contribute $100 to this column, but since it is in one bank account, one of you should pay $100 to the other via cash or check at the beginning of the month so you can then buy everything you need. If the other person spends grocery money from HIS account {$20}, you can rework the amount at the beginning of the next month and only have him pay you $80 instead.

So glad you are enjoying the series and that it’s working for you!

Alright, I will try as you suggest 🙂 Thanks so much for your help!!

All the best,

Daniela

Seriously, you are awesome! I feel so much more on track with my finances because of the printables you create. Thank you so much for sharing this!

You are very welcome! I’m so glad you are enjoying the series, and I really hope it helps!

This is very detailed! I like it!

My problem is not knowing what my husband is spending 🙂 lol. He also gets reimbursed for work expenses but we have to pay first. This, honestly, is doable but not ideal. But I like the credit card for that because occasionally trips will cost a couple grand and we might get reimbursed before the bill is due. If I have to transfer money from savings to cover it, I am sure to transfer the money back asap.

I know exactly what you mean. I find out about most of my husband’s spending when the bank statement comes, although he has committed to try very hard to keep track of his receipts since I started this series!

And that IS a pain to have to wait for expense reimbursement, especially when they are big amounts. It sounds like your system works really well though!